Benefits of Virtual Bookkeeping

No matter your industry, precise and efficient bookkeeping is essential. It can help you take control of your business finances and make smart, data-driven decisions. Fortunately, you don’t have to hire a traditional full-time, on-site bookkeeper.

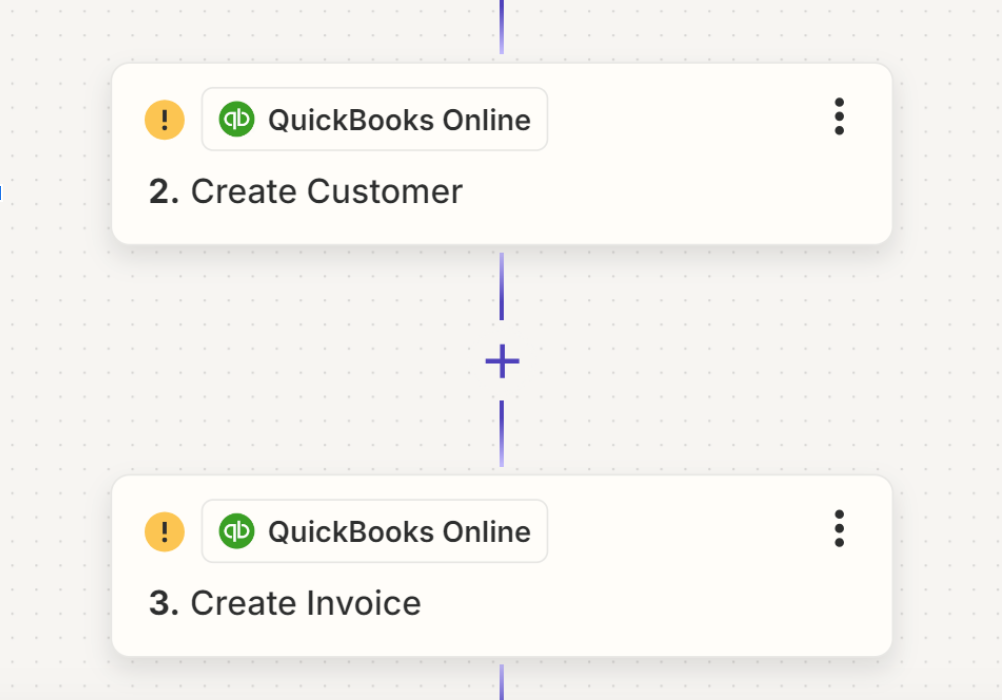

With a virtual bookkeeper, like GrowthLab, you can receive the support you need remotely. Similar to remote bookkeepers or online bookkeeping, they can record, store, and manage your financial transaction from any remote location. They can do this through a variety of online bookkeeping software programs and mobile apps - many of which you probably already use! Let’s dive deeper at the most noteworthy benefits of virtual bookkeeping.

1. Save Money

Hiring a full-time bookkeeper is expensive. You’ll have to cover their salary, payroll taxes, benefits, and insurance. It will also be your responsibility to pay for everything they need to perform their job: a desk, office supplies, software, etc. They can eliminate the high expense of a full-time bookkeeper and save you thousands upon thousands of dollars in the long run.

2. Reduce Fraud

Unfortunately, fraud occurs often with traditional bookkeepers. If a bookkeeper has a direct interest in your business, they may commit it. Virtual bookkeeping offers an easy way to reduce the risk of fraud as they are unbiased and known to commit their tasks honestly. They also cross-check their books multiple times prior to sending them to their clients.

3. Access Top-Notch Talent

If you hire an on-site bookkeeper, you may be tempted to choose an entry or junior level professional to save some money. If you opt for virtual bookkeeping, you can receive access to experienced, talented bookkeepers at a fraction of the cost. This means higher quality work, greater accuracy, and less errors. In summary, you can leverage the talent of different skill-levels that are optimized to what your business actually needs.

4. Save Time

There’s no denying that bookkeeping tasks are tedious and time-consuming. You can take them off your plate and allow your team to focus on more important tasks like coming up with new products and growing your business. You’ll be able to free up your schedule and direct your time and energy on what you’re good at.

5. Up-to-Date Books

If you partner with an experienced virtual bookkeeper, you can ensure your books are up-to-date at all times. They’ll receive access to your bank statements, receipts, and invoice so they can update your books accurately in real time. Since your books will always be updated, you won’t have to scramble during tax season or an audit.

6. Improved Business Management

It’s difficult to manage your business well when you can’t trust your numbers. They can keep you organized and provide the information you need to reduce inefficiencies, increase productivity, and set yourself up for growth. You’ll know how you’re spending money and be able to increase or decrease your budget accordingly.

Other Blogs Related to Small Business Accounting