Building a 13-Week Cash Flow

Whenever GrowthLab creates or teaches a customer how to build a 13-week cash flow, we lean into our 10-step approach to building a 13-week cash flow. We will deviate from some of these steps based on the unique business needs and internal functions. However, that is more of the exception than the norm.

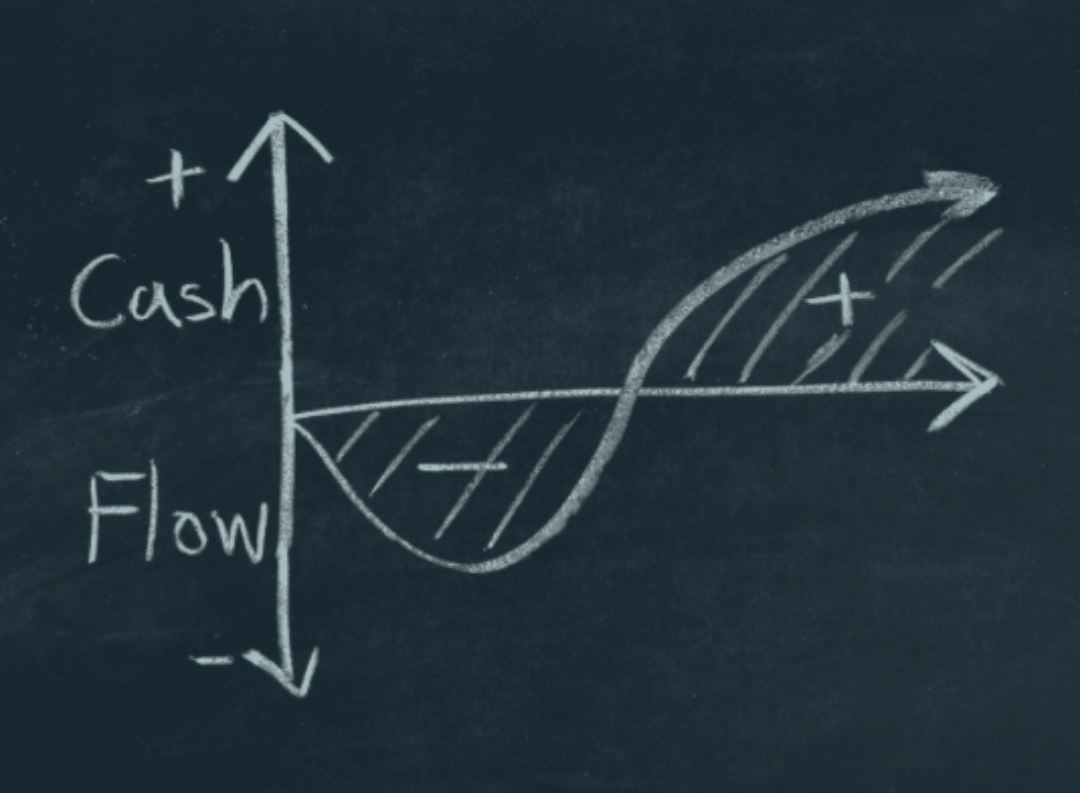

The 13-week cash flow forecast is a financial tool that provides insight into a company's short-term financial health by projecting weekly cash receipts minus cash disbursements. It is commonly used in turnaround situations when a company is experiencing financial distress to assess short-term options and liquidity issues. Company leadership, including the CEO and CFO, often relies on these models for weekly planning and quarterly strategy sessions to identify potential liquidity shortfalls and make informed decisions during times of financial uncertainty. If you want to learn more, read this blog: what is a 13-week cash flow.

Key Takeaways:

- Short-Term Visibility: A 13-week forecast provides a granular look at liquidity, helping businesses avoid insolvency during tight cash periods.

- Precision Over Projection: Unlike long-range plans, this model relies on precise timing of collections, payroll, and vendor payments.

- Vendor Prioritization: Use an A/B/C categorization method to manage accounts payable and preserve cash when necessary.

- Weekly Discipline: The model must be updated every Monday and reconciled every Sunday to identify variances between expected and actual cash flow.

Building a 13-week cash flow model differs from building an Annual Operating Plan (AOP) or a Long-rang Plan (LRP). The expectation is all about precision when companies are tight on cash where every dollar counts, precision around collections, wages, and vendor payments is critical and can mean the difference between survival and insolvency. It is a valuable financial tool for short-term cash management. It helps businesses optimize their cash flow by highlighting daily cash inflows and outflows over a shorter time horizon. This forecast enables companies to make informed decisions about investments, expenses, and other financial commitments in the short term, and let's not forget about stability and planning.

This forecasting tool is also crucial for managing debt service payments effectively. By estimating cash payments for each week, including bills, payroll, and debt service payments, you can ensure financial stability and the ability to pay lenders. This process requires collaboration between your finance, accounting, and management to update the model weekly with precision. We prefer to do this exercise on Monday mornings! Your banking and financial partners will thank you for this insight and confidence.

If you're looking for additional support, check out our FP&A Services or Virtual CFO Services.

A virtual or fractional CFO can be a valuable asset when it comes to managing your 13-week cash flow forecast. Their expertise and financial modeling skills are crucial in identifying potential issues and staying proactive and unbiased in addressing your cash reserve needs. By hiring a fractional CFO, you can ensure that your cash flow forecast is accurate and strategic, ultimately helping your business thrive and maintain sustainable growth.

Essential Steps to building a 13 week cash flow model:

Here's our process in 10 easy steps to get you back on track with your cash management and short-term projections

When building a 13-week cash flow forecast, it is crucial to tap into reliable data sources to ensure the accuracy of your projections. These data sources could range from bank accounts and enterprise resource planning (ERP) systems to accounts receivable (AR) and accounts payable (AP) ledgers. Many of us are using QBO or Xero, which are great platforms that can feed the data into your cash flow forecasting model. (Check out STRMS.io for automation opportunities) By consolidating historical data points and utilizing financial planning and analysis tools, you can effectively project future cash flows at a stream level. Having access to diverse data sources allows for a comprehensive analysis and forecasting of your cash flow over the specified period.

Step 1: Your Starting Balance is Your Beginning Cash Balance

Every Monday morning, we start the weekly process of updating the 13-week cash flow tool. We tally up your cash balances from all your bank accounts and update the beginning balance at the top of the sheet. We usually avoid going to all your bank portals to grab the balances as your instance of QBO or Xero will usually have the bank feeds directly linked, saving you time and effort.

Step 2: Anticipate Your Revenue and Know Your Invoicing Process

Cash flow is all about how much cash and timing of cash. On the revenue side, we start by understanding your invoicing cycle. Do you invoice daily, weekly, or monthly? Do you pull cash via ACH or credit card? Do you charge your customers up-front on an annual basis? Do you have annual contracts and monthly recurring revenue agreements? In developing a 13-week cash flow, timing is everything.

Recurring revenue businesses have this step fairly easy, but not every business has recurring revenue Anticipating customer demand can be daunting, but we do have a few tricks up our sleeves. One of our methods is to look at last year’s seasonal patterns and overlay growth with seasonality. Another method is the forward-looking approach which is possible when you have a purchase order (PO) process, a bidding process, or a quoting and estimating component. In this case, when we have a defined pipeline of revenue, we anticipate a certain conversion rate and certain conversion timing. Obviously, forward-looking customer demand is a better measure of anticipated revenue than the alternative.

Step 3: It all Starts With Your Collections

Our first step to driving cash inflows is to pull your accounts receivable aging report from your general ledger. If you don’t have one, you should! You should know who owes you money, how much, and when. GrowthLab will bucket your customers based on historical collection patterns. In other words, who owes you what in this week? Next week? And in week 6, for example. And be realistic. Don’t assume you’ll receive money immediately. Processing takes time. And know your Customer’s behavior: who usually pays you in 30 days, 60 days, and 90 days?

Step 4: Let’s Decide who you are Going to Pay & When

After GrowthLab has modeled out what cash you expect to receive, we figure out who you are going to pay. If your accounting is on an accrual basis, pull your latest accounts payable report by vendor and by due date. Once you have the aging report, categorize each vendor to prioritize payments:

- Category A: Critical vendors to be paid within the next 30 days.

- Category B: Important vendors to be paid within the next 60 days.

- Category C: Non-essential or flexible vendors to be paid at the end of the 13-week cycle.

Be careful, don’t squeeze your vendors too much, because one day you may need them.

Step 5: Payroll… an important line item in the 13 week cash flow projection

We know that for most companies, payroll is both the largest cash expense and the most predictable cash expense. GrowthLab will figure out what your anticipated payroll cash requirements are for each payroll.

To ensure accuracy, account for the following payroll variables:

- Frequency: Weekly, biweekly, semi-monthly, or monthly.

- Anomalies: Commissions, seasonal bonuses, or one-time severance payments.

- Contractors: Determine if they are paid via payroll or as standard vendors.

By the way… don’t forget about your contractors, some companies treat them like vendors, others pay them through payroll. What is your process?

Step 6: Monthly Recurring Expenses – Auto Debit & Credit Cards

Even though many companies are on accrual accounting, there are many expenses that impact cash flow immediately. Today it is very common for vendors such as software-as-a-service and other technology service providers to either pull funds directly from your bank account via ACH or debit or charge your credit card. Other expenses that are often billed this way are rent, mortgage, utilities, etc. The ACH and debit card transactions never hit your accounts payable and the credit card transactions are lumped together in your credit card bill.

To add credit card cash payment to your 13-week cash flow, GrowthLab will take a look at your bill for the next payment. To estimate future credit card bills, it is good practice to add up all recurring credit card transactions. Then add a buffer for non-recurring and ad-hoc expenses. Take this sum and then add it as the cash outflow your 13-week cash flow based on your credit card statement due date.

Step 7: Expecting the Unexpected in a 13 week rolling cash flow

One-off transactions catch all businesses by surprise. Machines break, computers need upgrading, accidents happen, HVAC systems go down, and customers take longer to pay you.

Building a 13-week cash flow tool gives you better visibility and decision-making ability when dealing with the unexpected. It is best practice to anticipate the need for a buffer to deal with the unexpected. You can build this buffer into your own cash balance — making it a “rule” that you don’t let your ending cash balance fall below $XXX. Another angle is to develop good banking relationships and establish a line of credit as a lifeline.

Step 8: Inventory Purchases

This won’t apply to every company, but for those who buy inventory: don’t forget the lumpiness of cash from inventory purchases. GrowthLab Starts by understanding your annual inventory turns and anticipating your customer demand cycle. GrowthLab will think about your inventory buying patterns over the last few months in an attempt to extrapolate that over the next 13 weeks. Overlay this with a schedule of inventory POs that you have issued (made a commitment to pay) and the timing of the due dates of those payments. Again, be more granular (use your POs) on the near-term weeks and project out (use your historic buying patterns) for the out-weeks where you don’t have visibility.

Step 9: Develop your 13 Week Cash Flow Forecast

Using the data that GrowthLab gathered above, we build out a spreadsheet where your columns are your 13 weeks and the rows make up your: cash balance, accounts receivable collections, accounts payable, and capital expenditures and special financing events. Then let's take your beginning cash balance on Monday, add in your weekly collections, subtract your accounts payable and any other cash outflow from inventory, capital expenditures, debt payments, etc. Add in any cash from new financing, and calculate your ending cash balance as of Sunday. Do that for all 13 weeks.

Step 10: Now Reconcile the 13 Week Cash Flow Analysis

GrowthLab will Reconcile your anticipated weekly ending cash balance with your actual ending cash balance on Sunday. Reconciling this means identifying the difference between (a) the cash balance you expected to end the week with versus (b) your actual ending cash balance and then identifying what happened or didn’t happen to cause the difference of (a) versus (b). And, lastly, GrowthLab repeats steps 1 to 10 every Monday! Make sure you know how to read a statement of cash flows so you can properly understand what the numbers mean.

Frequently Asked Questions About 13-Week Cash Flow Models

What is a 13-Week Cash Flow Model?

A 13-week cash flow model is a short-term financial forecast that projects a company's cash inflows and outflows on a weekly basis over a 13-week period, roughly covering one business quarter.

How Often Should the 13-Week Cash Flow Be Updated?

Ideally, it should be updated weekly to reflect actual cash flows and any changes in assumptions or business conditions.

How Detailed Should the 13-Week Cash Flow Be?

It should be detailed enough to capture all significant cash transactions, but not so detailed that it becomes cumbersome to maintain. The level of detail may vary depending on the complexity of the business.

How Can I Improve the Accuracy of My Cash Flow Projections?

Regularly compare actual cash flows to projections and adjust assumptions accordingly. Involve cross-functional teams (e.g., sales, finance, operations) to ensure all relevant information is considered.

Who Should Be Involved in Creating the 13-Week Cash Flow?

Typically, the finance team leads the process, but it’s important to involve department heads, the CFO, or other executives to ensure all relevant information is included.