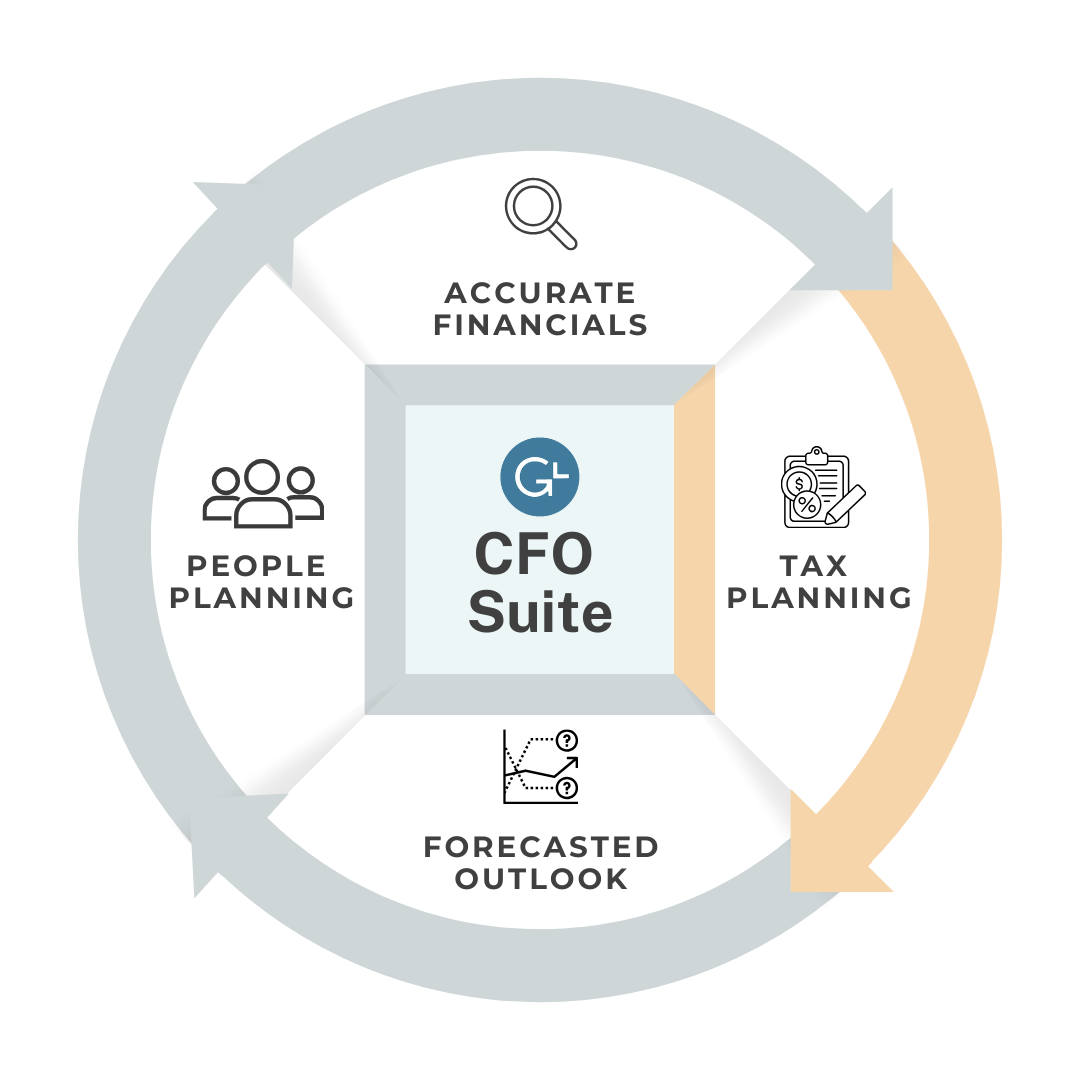

Tax Planning

Why Tax?

Peace of Mind Beyond Tax Filing.

At GrowthLab, we believe that managing your taxes should be a strategic, empowering, and simplified process by experienced, seasoned, and customer-centric tax professionals.

Our Virtual Tax Manager Services go beyond mere virtual tax filing to become an integral part of your financial strategy, and your accounting team (internal or external) ensuring that every decision is a step towards your financial growth and stability.

We’re not just accountants; we are your strategic tax partners, navigating you through the complexities of tax management, so you can focus on what you do best -- growing your business.

What We Do

Business Tax Filings

We prepare and file your federal, state, and local taxes, so you can stay compliant without the stress.

Year-Round Support

We don’t just show up at tax time. We’re here all year to answer questions, handle notices, and help you plan ahead.

Strategic Tax Planning

We help you think ahead—minimizing your tax liability and aligning your tax strategy with your growth goals.

Founder & Investor Support

We manage complex cap tables, equity events, and K-1s—making tax season smoother for you and your stakeholders.

R&D Tax Credit

We identify and file for R&D credits you may be missing—turning innovation into cash savings.

Multi-State & Nexus Review

We evaluate where you're doing business and where you're taxable, to keep you compliant in every state.

Entity Structuring Guidance

We help you choose and structure the right legal entity for your business, so you’re set up for tax efficiency from day one.

Review of Financial Statements

We review your financials before filing to ensure accuracy, consistency, and audit readiness.

and more...

The GrowthLab team, especially Stephen, has been incredibly helpful in guiding me through complex tax and payroll processes. They take the time to explain things thoroughly and equip me with knowledge. This not only ensures that everything is done correctly but also gives me confidence in managing these tasks. I highly recommend GrowthLab for their expertise and dedication to their clients’ success.

Paulina Echaide

Corporate Operations, Velou