What is Finance-as-a-Service?

Let’s Start by Identifying the Challenges FaaS Addresses.

Finance-as-a-Service (or FaaS) is more than outsourcing your non-core functions or your back office. Let's look at the big picture and examine the needs of a mid-sized business. These businesses today still need some level of insight, confidence, reliability, and timeliness of financial statements and performance feedback loops. The issue tends to be that this size organization can not afford the elevated capability nor do they have the capacity to recruit and build out a multifaceted finance and accounting team internally.

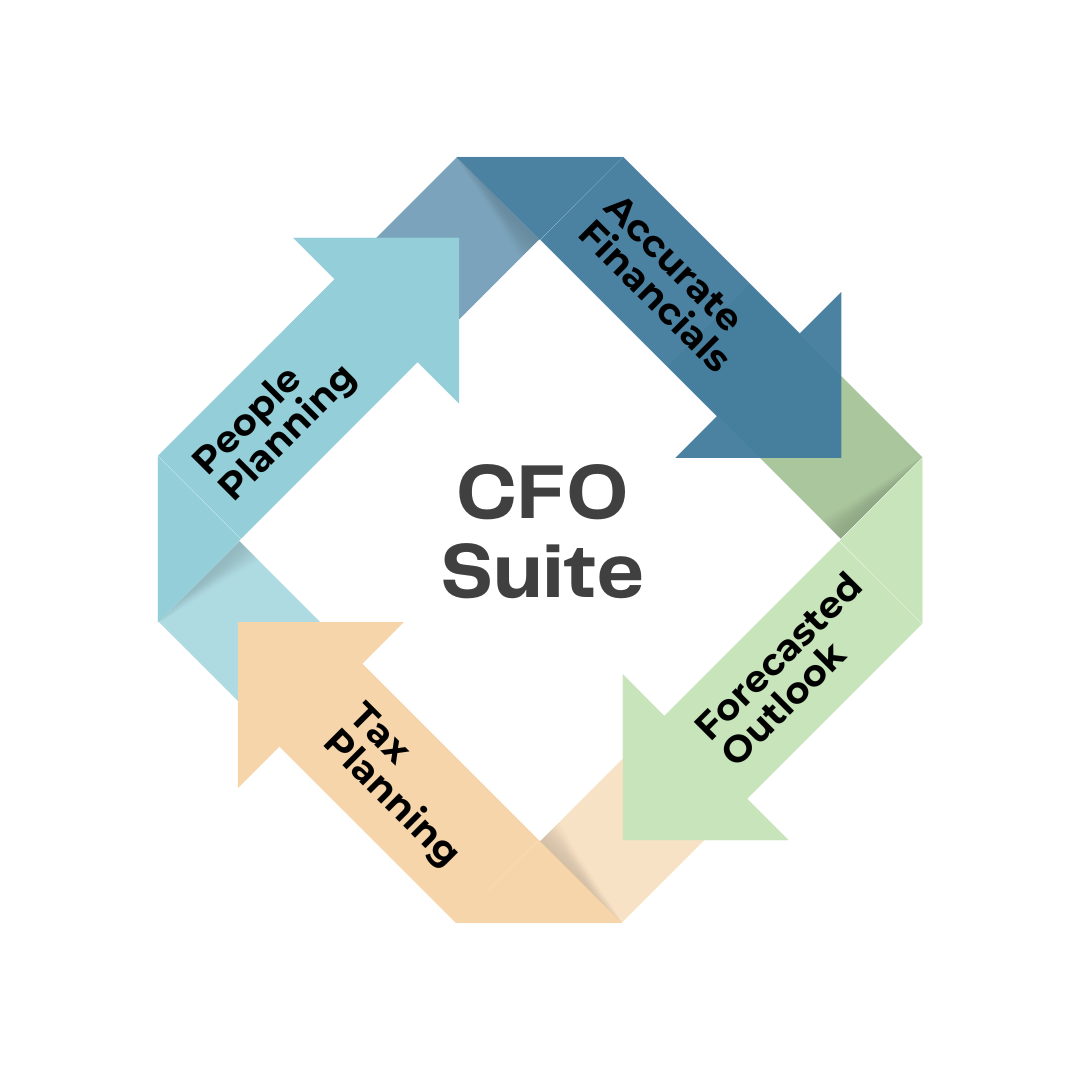

This is where FaaS providers come in, offering a solution to integrate financial, accounting, and business strategy value streams, addressing the challenges faced by small and medium-sized companies through the FaaS model. By outsourcing finance functions and accounting and bookkeeping tasks to specialized service providers, companies can benefit from increased efficiency, expertise, and cost savings through FaaS services and solutions, encompassing accounting, controllership, financial planning, business strategy, and tax filing and compliance.

Business owners still want everything they may have experienced in a larger organization, such as timely financials, accounting cadence (Accounting Calendar), elevated financial management, business intelligence, and the Strategic Business Cycle. And because they cannot afford to build out an entire accounting and finance team, they end up working in the business and not on the business.

Here's a great article by one of our co-founders on the GrowthLab way:

https://karbonhq.com/resources/start-offering-finance-as-a-service-to-your-clients/

What is Finance as a Service and How Does it Work?

Finance as a service (FaaS) is a cloud-based service that offers financial tools and capabilities on a monthly subscription basis. It allows businesses to access a range of finance-related services like bookkeeping, bill pay, FP&A, and accounting without the need for a large upfront investment in infrastructure or software.

Hiring a Virtual CFO or Remote Bookkeeping Firm?

Here is a great resource before you make a decision: 20 questions to ask when thinking of hiring a FaaS Firm

Advantages of Outsourced Bookkeeping from a FaaS Firm

Outsourcing bookkeeping services offers numerous advantages to businesses. By partnering with a FaaS provider for bookkeeping needs, companies can benefit from expert financial guidance and support without the need to hire in-house bookkeeping staff. This allows organizations to focus on their core competencies while ensuring that their financial records are accurate, up-to-date, and compliant. Additionally, outsourcing bookkeeping services can result in cost savings and improved efficiency, as FaaS firms leverage technology and expertise to streamline the accounting processes for their customers. This is especially beneficial for financial operations, as FaaS firms are experienced with current technology and can provide highly scalable solutions for businesses.

Finance-as-a-service has revolutionized the accounting services industry, making it more accessible and efficient for businesses of all sizes. By leveraging outsourced accounting services, companies can focus on their core operations while leaving the financial management to experts, such as financial experts and accountants from the largest startup-focused accounting firm in the United States. These services often include

bookkeeping, controllership accounting,

tax compliance, and tax planning services provided on a recurring monthly basis. This shift towards Client Accounting Services (CAS) by CPA firms has streamlined processes and allowed for more

strategic financial planning and business growth opportunities.

A finance team is essential to the success of any business. They provide expertise in financial management, strategic planning, and

budgeting to help companies thrive. With experienced professionals like former founders and corporate finance professionals on board, businesses can gain valuable insights and make informed decisions to optimize their financial performance. GrowthLab can offer not just outsourced accounting services but also take on an advisory role to help our customers achieve their goals. As your trusted bookkeeper and

CFO, we also help you with due diligence to position you for success in your next round of fundraising.

Benefits of Finance-as-a-Service

Consolidation Under One Roof

FaaS companies offer value streams that are consolidated under one roof. Not only is this more convenient, but it also saves businesses on costs too.

Cohesive Internal Teams

FaaS also offers something like having multiple internal teams operating cohesively as one. This can lead to smoother processes and organized financial management.

Focus on Execution and Business Continuity

By adopting robust systems and standard operating procedures, FaaS companies achieve a focus on execution and business continuity. This gives businesses a competitive advantage in the market.

Real-time Customized Reporting and Dashboards

FaaS companies can easily tailor their services to your unique business situation. This includes providing real-time customized reporting and dashboards that help you monitor business performance, especially with our FP&A Service.

Leverage Technology

A Finance-as-a-Service company looks very different than your typical accounting, advisory, or finance firm. This is due to the fact that FaaS firms leverage new technology, scalable systems, and standard operating procedures to increase their agility and responsiveness, providing customized financial reporting and advisory services in real time. FaaS isn’t the same as traditional accounting, as it operates differently and utilizes new technologies to provide efficient and personalized services, including payroll management. With this being said, they are able to meet the needs of your unique business in real time, providing customized reporting and advisory services.

Flexible Pricing Options

Another key advantage of using FaaS companies is flexibility in pricing options. Many firms have dropped the billable hourly model and instead provide these services as recurring monthly fixed-fee contracts, giving businesses a single view of their operating costs. This allows you to manage cash easily and maintain high standards, giving your workforce greater freedom to focus on higher-value tasks and generate the insights the business needs to help chart the right path for growth. FaaS companies prioritize what accounts need the most attention while automating routine functions that are essential but painstaking to execute. With fixed fee pricing, businesses can avoid taking on costs for tedious back-office functions.

WHY WE ARE THE BEST FIT

All the services you need, all in one place.

Business accounting is more than just basic bookkeeping, it is a core business function focused on the collection, compilation, and organization of operational and financial data.

GrowthLab has over 20 years of experience with start ups, small businesses, and larger companies. GrowthLab is built around helping companies understanding the following four challenges …

- Insight into your

cash flow

- Determining where you are making and losing money

- Marketing for profit

- Paying for performance

Frequently Asked Questions About FaaS

What is the difference between Finance as a Service and traditional accounting?

Traditional accounting is usually managed in-house with a dedicated finance team, while FaaS outsources these functions to external providers. FaaS typically offers more flexibility, scalability, and access to technology compared to traditional in-house teams.

Is Finance as a Service suitable for small businesses?

Yes, FaaS is particularly beneficial for small businesses that may not have the resources to maintain a full in-house finance team. It allows them to access high-quality financial services at a lower cost and scale as the business grows.

What types of companies should consider Finance as a Service?

Companies of all sizes and industries can benefit from FaaS, particularly those looking to reduce costs, improve efficiency, access financial expertise, or those undergoing rapid growth or transformation.

Can Finance as a Service help with financial planning and analysis?

Yes, FaaS providers often include financial planning and analysis (FP&A) services, helping businesses with budgeting, forecasting, financial modeling, and strategic planning to drive growth and profitability.