Why Accounting?

ACCURATE FINANCIALS

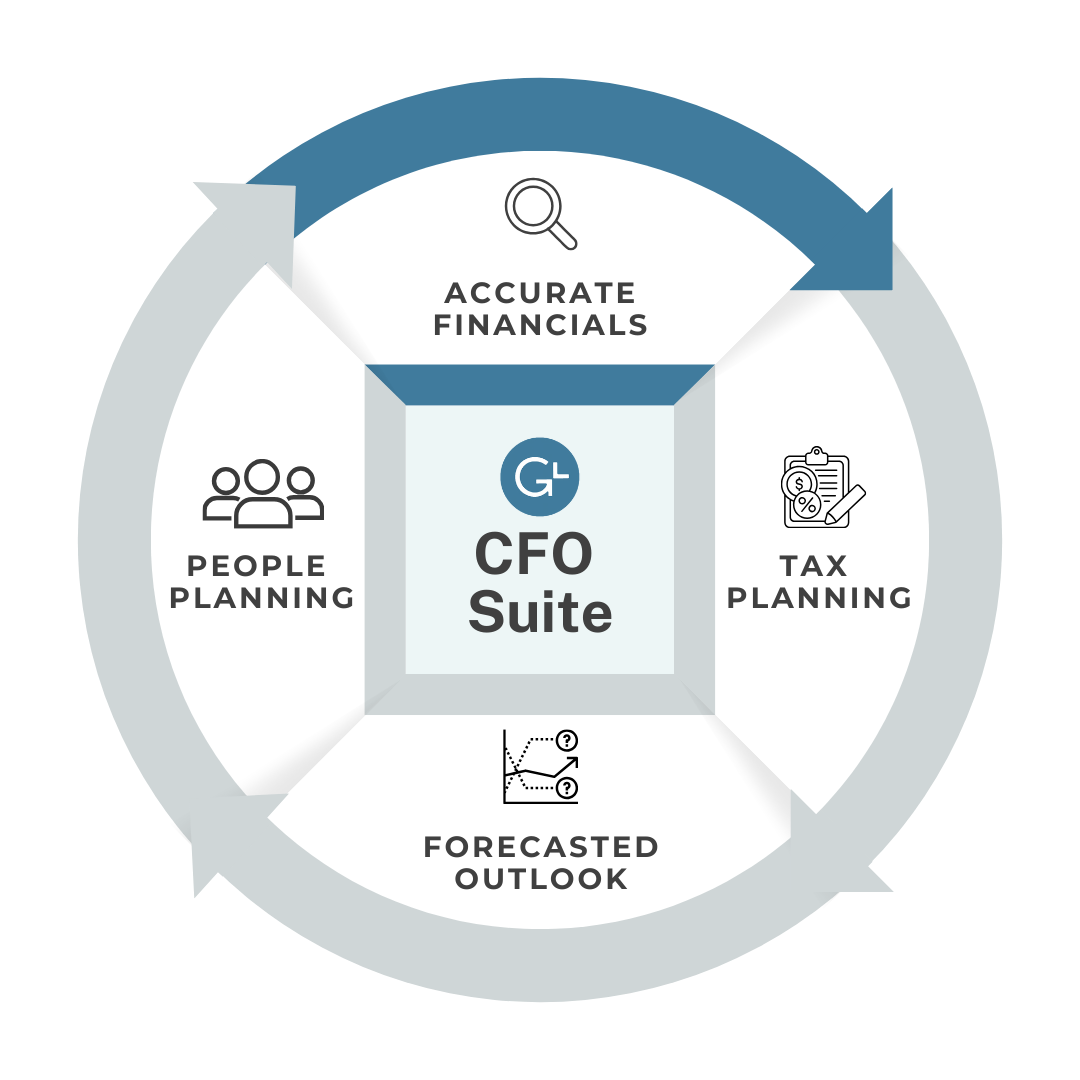

Real growth isn’t just better accounting or better bookkeeping, but rather thoughtful, elevated strategies throughout your business to inform smart, long-term growth.

Accounting is the backbone of any financial management system. The GrowthLab Suite builds on this foundation, providing you with a cohesive approach that includes accounting, tax, FP&A, and HR – all designed to support your goals.

WHY WE ARE THE BEST FIT

All the services you need, all in one place.

Business accounting goes beyond basic bookkeeping – it’s a foundational function within your business financials. While much of this process takes place in your general ledger system, our accounting services extend to essential workflows, including vendor payments, customer invoicing, receivables collection, cash-control reconciliations, and working-paper management to support a clear and accurate balance sheet. With the GrowthLab Suite, your accounting functions become a streamlined, fully integrated part of your financial management system, setting the stage for growth

... GrowthLab is LEAGUES ahead of all of the others I worked with. They're professional, efficient, and kind people, and when I meet with my account manager, I'm always really impressed by how quickly she can make updates when we need them- she knows the software so well that what takes her about 2 seconds to do would have cost me an hour in researching and poking around different screens. I can't suggest them highly enough. They are worth every dime of the investment you make into their services, and if you're a small business owner, the relief of having this responsibility off your shoulders is invaluable.

Brittany Bennett

CEO at House of a Different Color

What We Do

Historical Cleanup

We get your books cleaned up, fast—so you can confidently report to banks, boards, and tax authorities.

Actuals-to-Budget

We show you how your actuals stack up against your budget—helping you course-correct and stay on track.

Grant Accounting

We handle the compliance, tracking, and reporting that comes with managing grants—so you stay audit-ready and stress-free.

Reconciliations

We take care of your bank and credit card reconciliations—so your books stay accurate and investor-ready.

Month-End Close

We manage your monthly close process—on time, every time—so you get accurate financials without the scramble.

AP & AR Support

We streamline your AP/AR processes—helping you manage cash flow and vendor/customer relationships more effectively.

Audit Prep

We get your financials and documentation organized—so audit season doesn’t become panic season.

Payroll Coordination

We partner with our HR team to ensure accurate, timely payroll entries and reporting.

and more...

Join the 950+ businesses that have transformed their operations with GrowthLab Financial's full suite of financial services.

Helpful Resources