Extend Your QBO Lifespan with Integrated Automations

In the world of accounting, we hear it all the time from customers… should I move to NetSuite? What often ensues is a conversation around value. What will NetSuite provide them that Quickbooks cannot? Oftentimes this is a result of customers seeing an ad that promises them the world. Or maybe it’s due to NetSuite's integrated sales management and CRM tool. Whatever the trigger for the discussion is, they are valid concerns and thoughts. But… what if…. Just if… you could stay on Quickbooks Online (QBO), retain the team that knows and love Quickbooks, integrate your sales and marketing function without giving access to sensitive financial data… and not have to flip the accounting function upside down.

The Power of the QuickBooks Online API

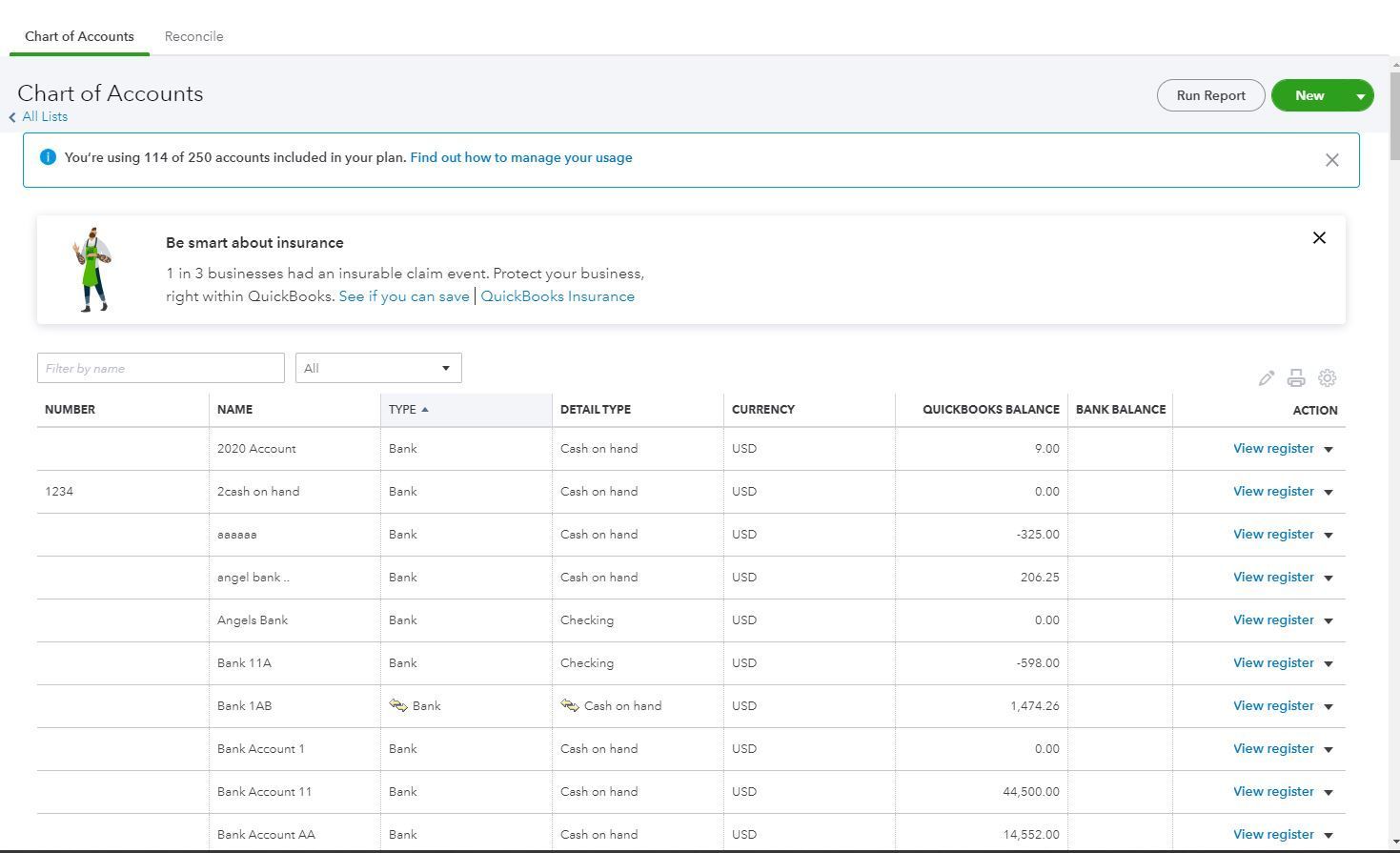

One of the most significant advantages of QBO is its extremely versatile API, which allows seamless integration with various platforms. Accountants do not commonly know APIs… nor should they! In short, the API is code that allows you to connect two different platforms and sync (or move) data seamlessly. By leveraging the QBO API, businesses can create custom automations that enhance functionality and improve efficiency without the need to switch to more expensive systems like NetSuite.

Let’s take Hubspot, for example. It is one of the top CRM and Sales Management tools for small—to medium-sized businesses.

Integrating QuickBooks and HubSpot

Access Controls

Sales teams and accounting teams aren’t perfectly in sync. While we wish they were, this is the reality for most businesses. Business leaders don’t want sales teams in the financials due to controls and sensitive information, and they also don’t want the accounting teams in the sales platforms because, well, it’s not where they should be. Leveraging the API of Quickbooks Online and your sales platforms allows businesses to automate data into QBO based on events within the sales pipeline, without any human intervention. Imagine your sales team closes a new deal, and invoices are automatically created. No need to change Pipeline tools, no need to flip over the accounting tools.

Expanding Customer Insights

Connecting HubSpot with QuickBooks gives your team a comprehensive view of all customer activities, interactions, and payments in one cohesive place. Forget the days of having to go to three different systems to get the data you need. While using the QBO API, you can sync the metrics or data points where you need it, and when you need it, so that you, the sales team, and finance teams all have the data they need at their fingerprints.

Automated Actions

Even with so-called “all-in-one” ERP systems, your workflows aren't automated or optimized. Often, these systems are built with a modular architecture, meaning the sales platform is still disconnected from the finance function, and it feels like you need a PHD in software development to connect the dots. With the leverage of custom integrations, you can actually automate more of your current workflows. For example, payments are received on an invoice in Quickbooks, and you automatically inform the sales team and update their pipeline tools with the data they need. Or, perhaps the payment is outstanding, imagine automatically notifying the sales rep that they need to follow up with the customer.

Addressing the Key Pain Points of Switching from QBO to NetSuite

Costs

Transitioning to NetSuite can be cost-prohibitive, often ten times (if not more) the expense of QBO. Beyond the initial investment, ongoing management and maintenance costs can strain resources. These migrations can not only be painful but also time-consuming and detract from where business owners' focus should be… growing their business!

Talent Acquisition and Retention

QBO is widely known and used in the accounting community, making it easier and more cost-effective to find talent that has used it, or can pick it up very easily. In contrast, the specialized knowledge required for NetSuite can make hiring and training a drag. With fewer people familiar with NetSuite, businesses can expect much more difficult recruiting processes and longer training times if they find someone without historical training. All in all… increasing risk where it isn’t necessary.

How To Integrate Your CRM & HubSpot

Now, I know you’re reading this thinking… This is all great, but I’m not a developer. The good news is you don’t need that background. There are a few ways firms and businesses can accomplish these automations and integrations.

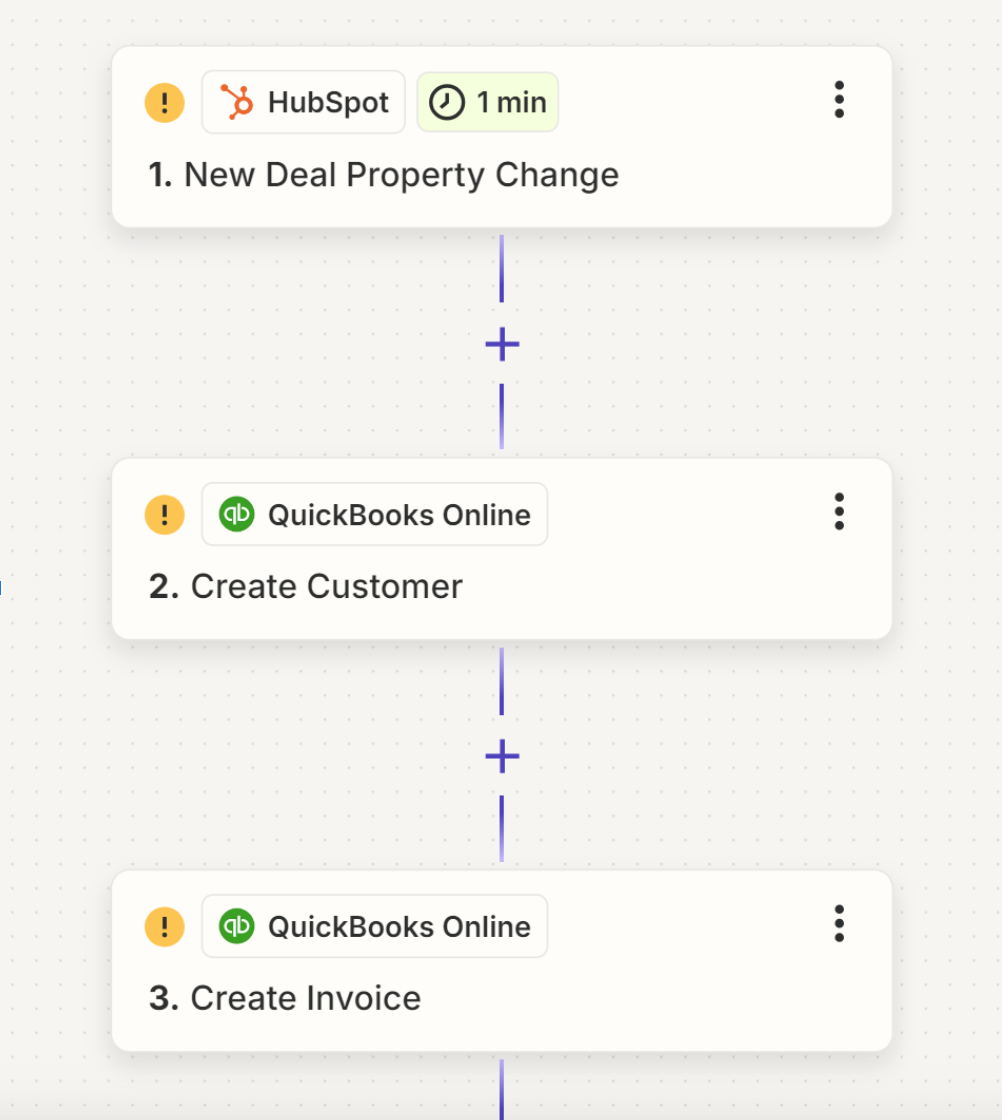

The first would be a DIY approach,

leveraging tools such as Zapier. While this is the easiest and quickest way to accomplish what you’re looking for, it will also require some time in testing and creating the integration. Know that no automation is truly one-and-done. They will all require monitoring, because the last thing you want to do is forget to invoice a customer! Below is an example of a simple and easy automation with Zapier to connect HubSpot and QBO using Zapier.

The second way to accomplish this is using an outside organization that will build and manage these integrations for you. And before you think of the cost, most of these outsourced developers will do this for a lot less than what it would cost to stand up and train on NetSuite! GrowthLab has partnered with STRMS.io to build and manage these integrations across all our customers!

In Conclusion

By leveraging the QBO API for custom automations, accounting firms can provide their clients with extended use of QuickBooks, avoiding the high costs, complexity, and talent risk of switching to NetSuite. This approach not only saves money but also allows business owners to work on their business instead of in it. And for us accountants out there, we get to continue supporting the customer where they need it most… being their trusted advisor.

This is a paid partnership with Intuit.

Korey Cournoyer

As Director of Corporate Development & Strategy at GrowthLab Finance-as-a-Service,

Korey works across the organization to drive transformation across teams, technology, and processes. From developing and implementing long-term business strategies to overseeing various departments at GrowthLab, Korey is a business and functional expert. Korey is also the CEO of

STRMS.io, which builds automated workflows for accounting firms, allowing them to spend more time with clients, ensure high-quality deliverables, and drive additional revenue.

More Blogs Related to Quickbooks

GrowthLab, a Finance-as-a-Service (FaaS) company serving founders and management teams with full-service Financial Planning & Analysis, Monthly Accounting, Virtual CFO, HR-People Advisory, and Business Tax.