How do you Create a Credit Memo in Quickbooks Online

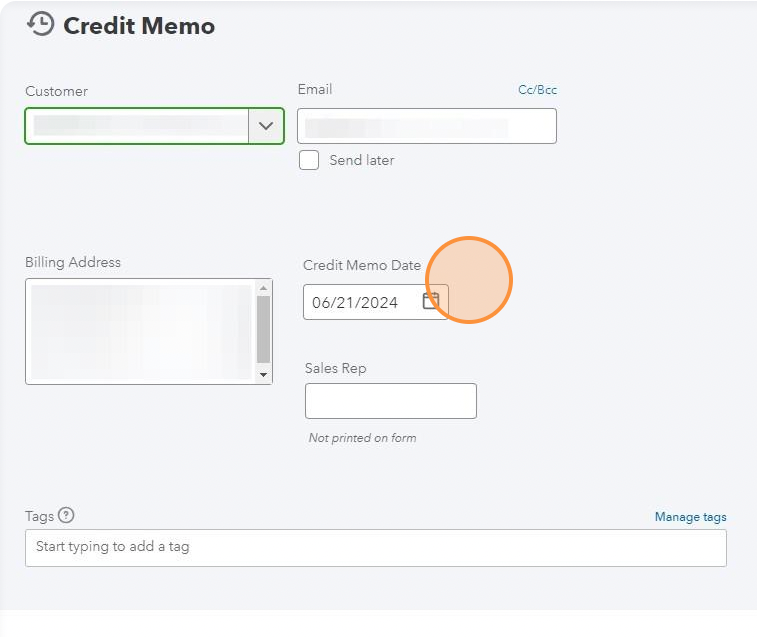

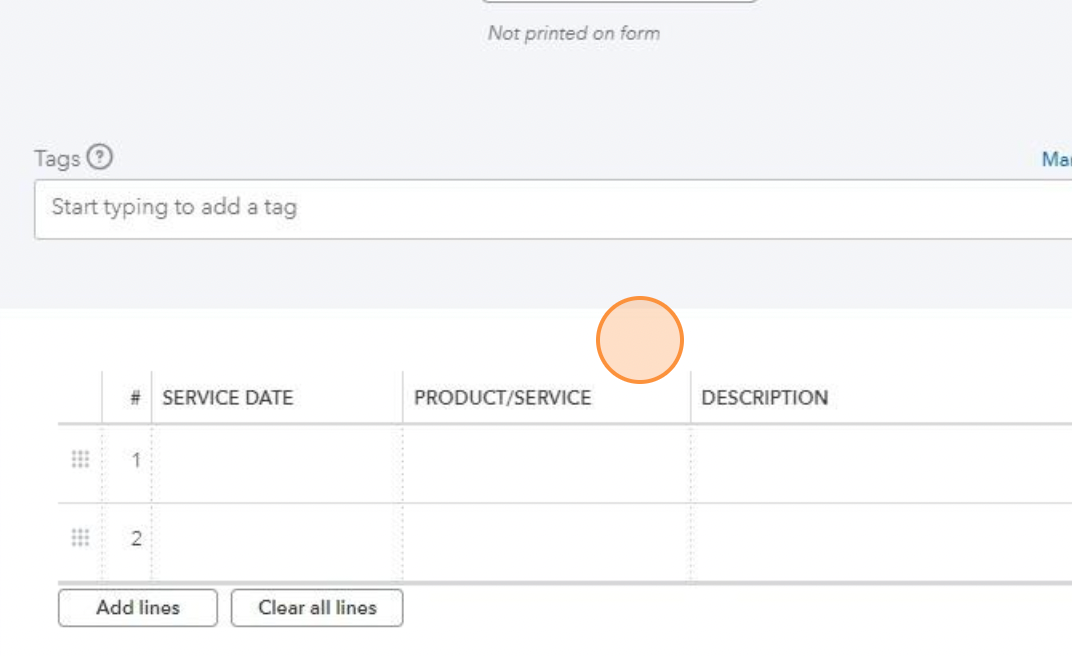

Step 3: Fill in the Credit Memo Details

- Enter the Credit Memo Date. Choose the date when the credit memo is being issued.

- Reference the Original Invoice (if applicable). If the credit memo is related to a specific invoice, include the invoice number for reference.

- Add Products/Services. Enter the products or services for which the credit memo is being issued. Adjust quantities and rates as needed.

- Adjust Amounts. If the credit memo is for a return or discount, adjust the amounts accordingly. QuickBooks will automatically calculate the new totals.

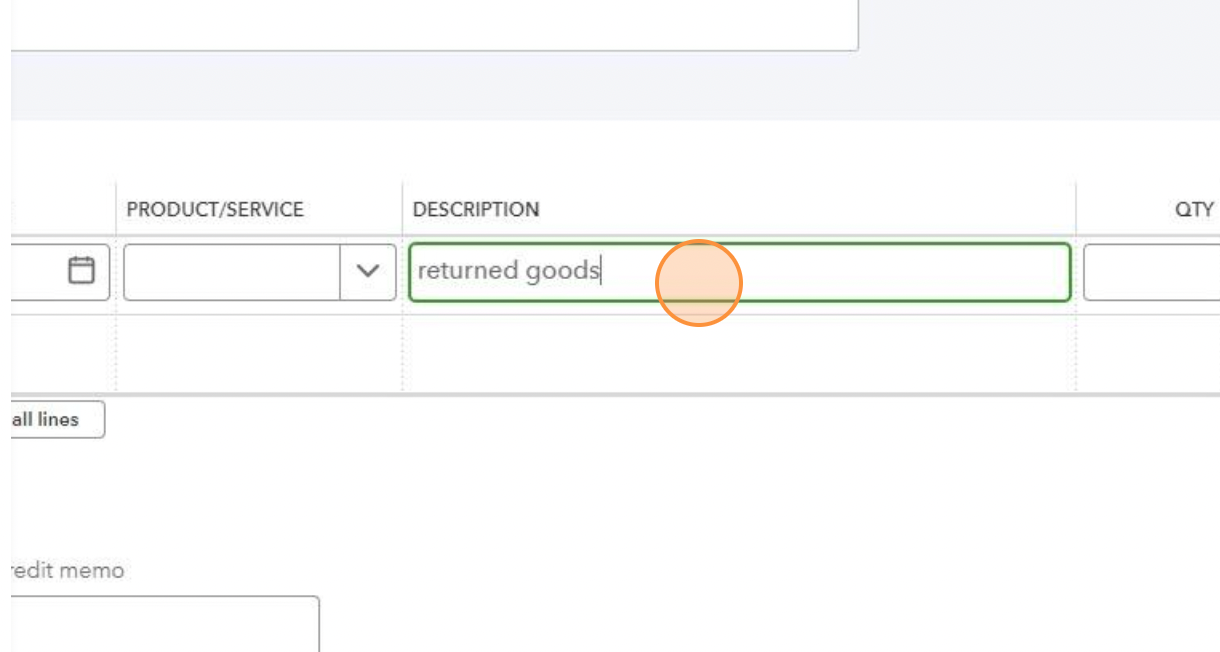

Step 4: Provide a Reason for the Credit Memo

- Describe the Reason. It’s important for record-keeping to include a reason for the credit memo. Use the description field to detail why the credit memo is being issued, such as "returned goods" or "pricing adjustment."

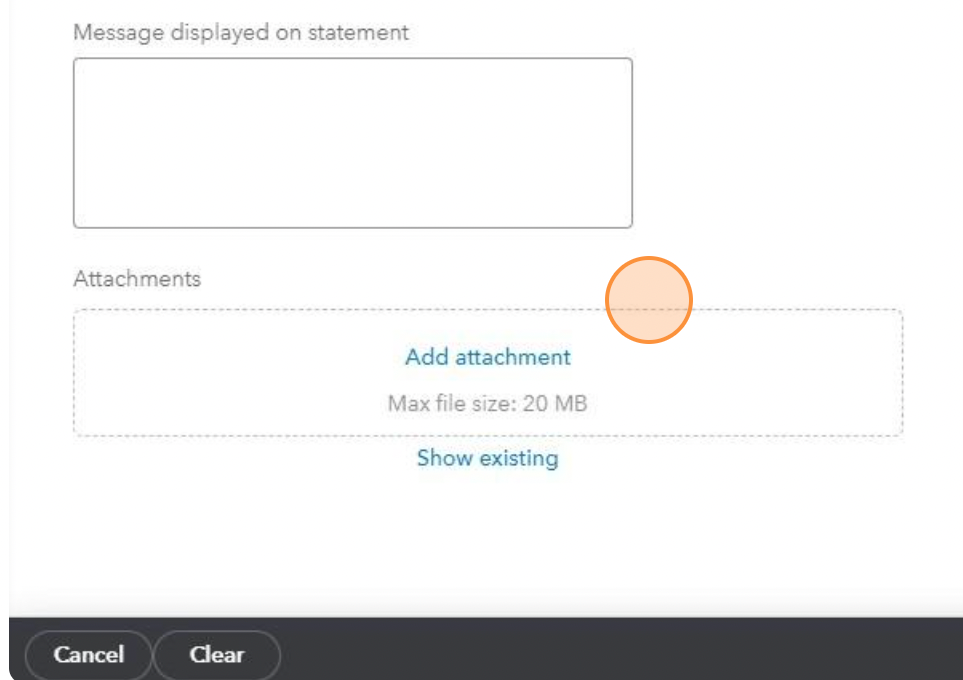

Step 5: Review and Confirm

- Review the Credit Memo. Ensure all information is accurate: customer details, products/services, amounts, and reasons.

- Attach Any Relevant Documents. If you have related documents (e.g., return slips, emails agreeing to a discount), attach these to the credit memo record in QBO for future reference.

Step 6: Apply the Credit Memo to an Invoice or Refund

- Apply to an Open Invoice. If the customer has other open invoices, you can apply the credit memo to those invoices directly from the credit memo screen. Choose “Apply to an invoice” and select the invoice you want to apply it to.

- Issue a Refund. If there is no open invoice or you need to refund the customer, select “Refund” from the credit memo screen. You will need to enter additional details like the refund method and bank account used for the refund.

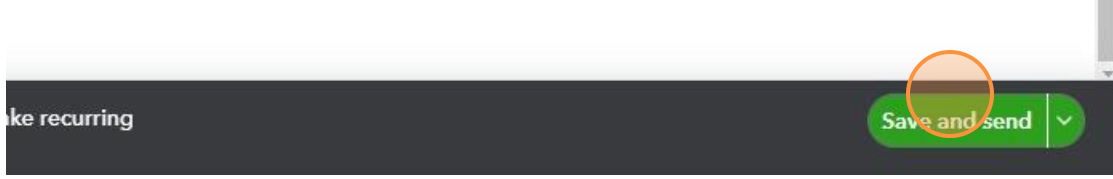

Step 7: Save and Send the Credit Memo

- Save the Credit Memo. Once all details are confirmed, save the credit memo.

- Send the Credit Memo to the Customer. You can email the credit memo directly from QBO to the customer for their records.

Step 8: Monitor the Credit Memo

- Keep Track of Applied Credits. Monitor your customer’s account to ensure that the credit memo is applied correctly and that all balances reflect the latest transactions.

- Review Financial Reports. Regularly check your financial reports to see how credit memos are affecting your overall financial situation.

By following these steps, you can effectively manage credit memos in QuickBooks Online, ensuring that your financial records are accurate and up-to-date. This will help maintain good customer relations and proper

accounting practices.

Other Blogs Related to Small Business Accounting

A Profit & Loss (P&L) statement, also known as an income statement, is one of the most essential financial documents for any business. It provides a snapshot of your company’s revenues, costs, and expenses over a specific period, helping you gauge profitability and financial health. But if you’re not an accountant, reading a P&L can feel like deciphering another language.