Credit Memos

Definition of a Credit Memo

A credit memo, short for "credit memorandum," is a document issued by a seller to a buyer. It reduces the amount that the buyer owes to the seller. This document is typically used when the buyer returns goods, there is a price dispute, or a previous invoice has overcharged the buyer. It serves as a way to correct financial discrepancies between trading partners and ensure accuracy in bookkeeping. Understanding what a credit memo is, why it is issued, and how it impacts financial statements is crucial for anyone involved in accounting or managing a business.

Reasons for Issuing a Credit Memo

- Returns and Allowances: One of the most common reasons for issuing a credit memo is the return of goods. If a customer returns a product for a refund, the seller issues a credit memo to reduce the receivable from the buyer, essentially acknowledging that the buyer no longer owes the amount for the returned goods.

- Pricing Discrepancies: Sometimes, errors may occur in the invoicing process, such as incorrect prices being charged. In such cases, a credit memo is issued to adjust the invoice amount to the correct value.

- Quality Issues or Damage: If goods delivered are damaged or fail to meet quality standards, the buyer might not return the goods but negotiate a reduced price. A credit memo is then issued by the seller to account for the reduction in price.

- Overpayment: In situations where a buyer overpays an invoice, the seller can issue a credit memo for the overpaid amount, which can either be refunded or applied to future purchases.

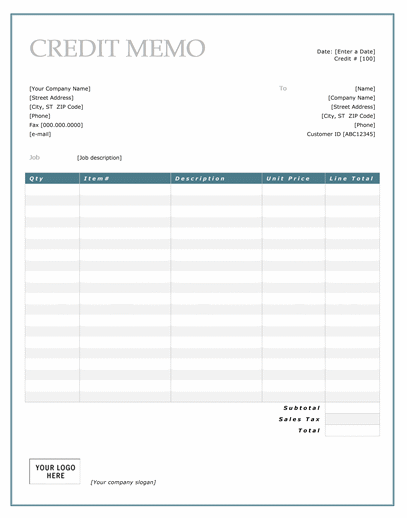

Components of a Credit Memo

A typical credit memo includes several important elements to ensure clarity and accuracy:

- Seller’s Details: Includes the name, address, and contact information of the seller.

- Buyer’s Details: Similar details of the buyer.

- Credit Memo Number: A unique identifier for the document.

- Date: The date when the credit memo was issued.

- Reference: The original invoice number related to the transaction.

- Items Adjusted: A list of items that the credit memo covers, including quantities and reasons for the adjustment.

- Total Amount Credited: The total amount that has been deducted from the buyer's balance.

Impact on Financial Statements

Credit memos affect several aspects of financial statements:

- Income Statement: For the seller, returns or allowances represented by credit memos lower the total revenue, thus impacting the net income.

- Balance Sheet: Reductions in accounts receivable (seller side) and accounts payable (buyer side) adjust the current assets and liabilities, respectively.

Example Scenario

Imagine a company, ABC Corp., sells goods worth $1,000 to XYZ Inc., but the goods delivered were damaged. XYZ Inc. agrees to keep the damaged goods for a discount of $300. ABC Corp. issues a credit memo of $300 to XYZ Inc., adjusting the original invoice amount. In ABC Corp.’s books, sales revenue and accounts receivable will be reduced by $300. In XYZ Inc.’s books, the accounts payable will be reduced by the same amount.

Accounting for Credit Memos

From an accounting perspective, a credit memo is recorded as a reduction in sales revenue by the seller and a reduction in accounts payable by the buyer. When a seller issues a credit memo, it must decrease its accounts receivable and its sales revenue figures. For the buyer, a credit memo means a reduction in accounts payable, as they now owe less money to the seller.

Other Blogs Related to Small Business Accounting