All Blogs

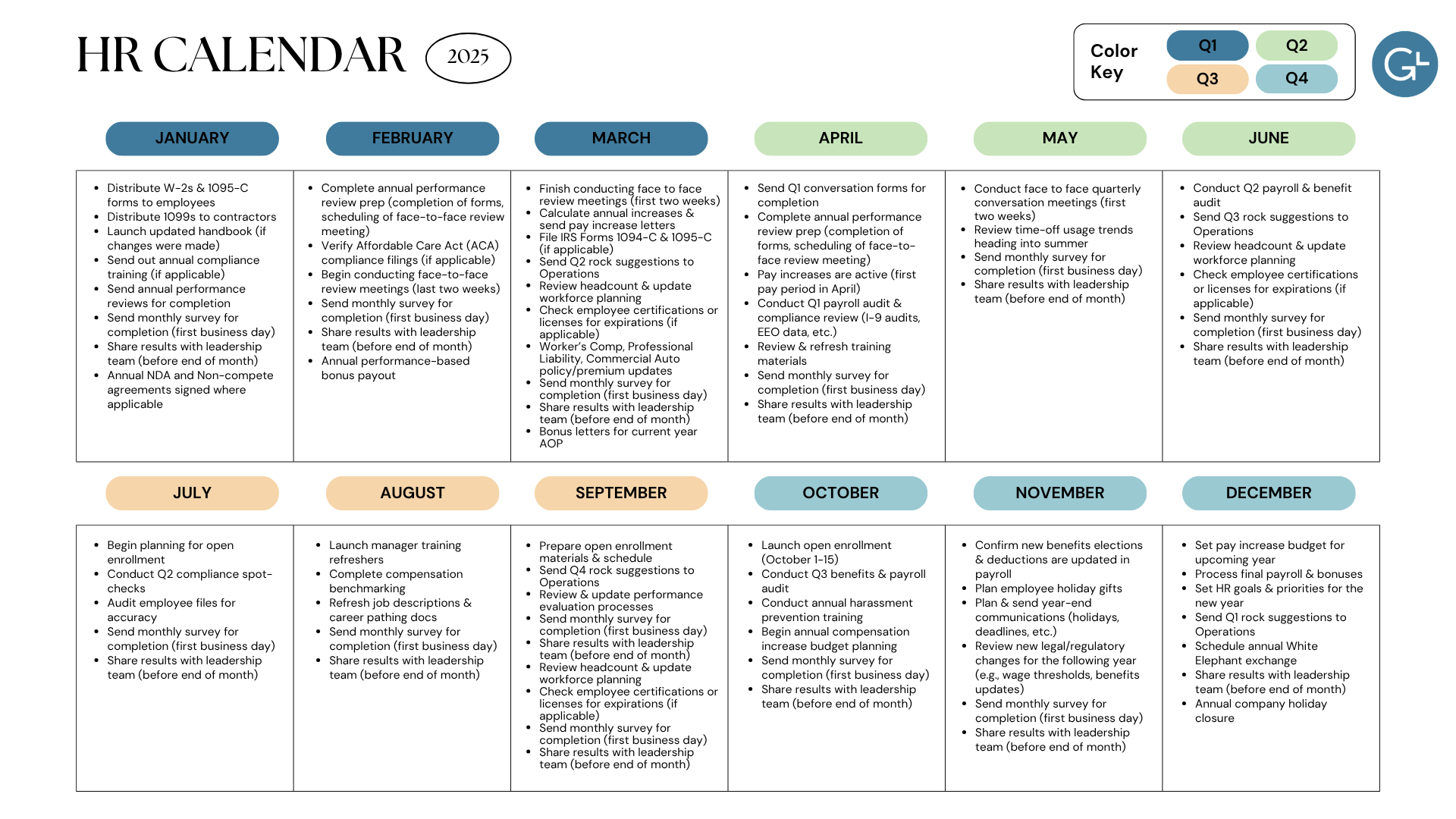

Managing payroll isn’t just about issuing paychecks on time; it’s about doing it in a way that aligns with federal and state regulations, ensures fairness, and supports your team. Throw benefits into the mix, with their variety of options and constantly changing rules, and it's easy to see why many businesses struggle.