The 5 Most Common Cash Flow Mistakes

Cash flow is the lifeblood of any business. Yet, many business owners and finance teams unknowingly make critical mistakes that put their companies at risk. While profitability is important, even profitable businesses can struggle, or fail, due to cash flow mismanagement.

At GrowthLab, we’ve worked with hundreds of businesses to optimize their financial operations. Below are five of the most common cash flow mistakes we see and practical ways to fix them.

1. Not Having a Cash Flow Plan

A cash flow plan isn’t just a “nice-to-have”, it’s a necessity. Many businesses operate without a clear strategy for managing cash inflows and outflows, leading to unexpected shortfalls.

How to Fix It:

- Use a 13-Week Cash Flow Forecast – This short-term planning tool helps predict upcoming cash needs. Learn how to build one here.

- Align Cash Flow with Business Goals – Budget for major expenses, tax payments, and seasonal fluctuations in revenue.

- Review & Adjust Regularly – A static cash flow plan won’t help. Update your forecasts weekly or monthly to stay ahead of surprises.

Pro Tip: Even small adjustments, like negotiating payment terms with vendors or invoicing clients faster, can make a big difference in your cash flow.

2. Overestimating Cash In / Underestimating Cash Out

It’s easy to be overly optimistic about incoming revenue, but failing to account for delays in payment, slow sales periods, or unforeseen expenses can lead to serious cash shortages.

How to Fix It:

- Use Conservative Revenue Projections – Base forecasts on historical data, not just best-case scenarios.

- Overestimate Expenses – Add a buffer (5-10%) to your expected costs to prevent under-budgeting.

- Track Payment Timelines – Understand your customers’ payment behaviors to avoid cash flow bottlenecks.

For a more in-depth approach, read our guide on

How to Budget for Employee Benefits.

3. Not Maintaining a Cash Reserve

Many businesses operate with little to no cash cushion. When unexpected expenses arise—like a late-paying client, equipment failure, or an economic downturn—they struggle to stay afloat.

How to Fix It:

- Set a Cash Reserve Goal – Aim to keep 3-6 months’ worth of operating expenses in a reserve account.

- Automate Savings – Set up an automatic transfer to a separate business savings account each month.

- Plan for Worst-Case Scenarios – Identify potential financial risks and create a backup plan.

Why It Matters: Businesses that maintain a cash reserve have a significantly higher survival rate during economic downturns (Harvard

Business Review).

4. Poor Accounts Receivable Management

Slow-paying customers can cripple your cash flow. Many businesses fail to establish strong invoicing policies, leading to delays in collecting payments.

How to Fix It:

- Invoice Promptly & Clearly – Send invoices immediately after work is completed. Use automated invoicing software to streamline the process.

- Follow Up Consistently – Implement a structured follow-up system for late payments.

- Offer Early Payment Incentives – Provide discounts for customers who pay before the due date.

Check out our

5 Tips to Managing Your Accounts Receivable for a deeper dive into AR best practices.

5. Confusing Profit with Net Cash Flow

A business can be profitable on paper but still run out of cash. Profit is what’s left after expenses, while cash flow reflects the actual movement of money in and out of the business.

How to Fix It:

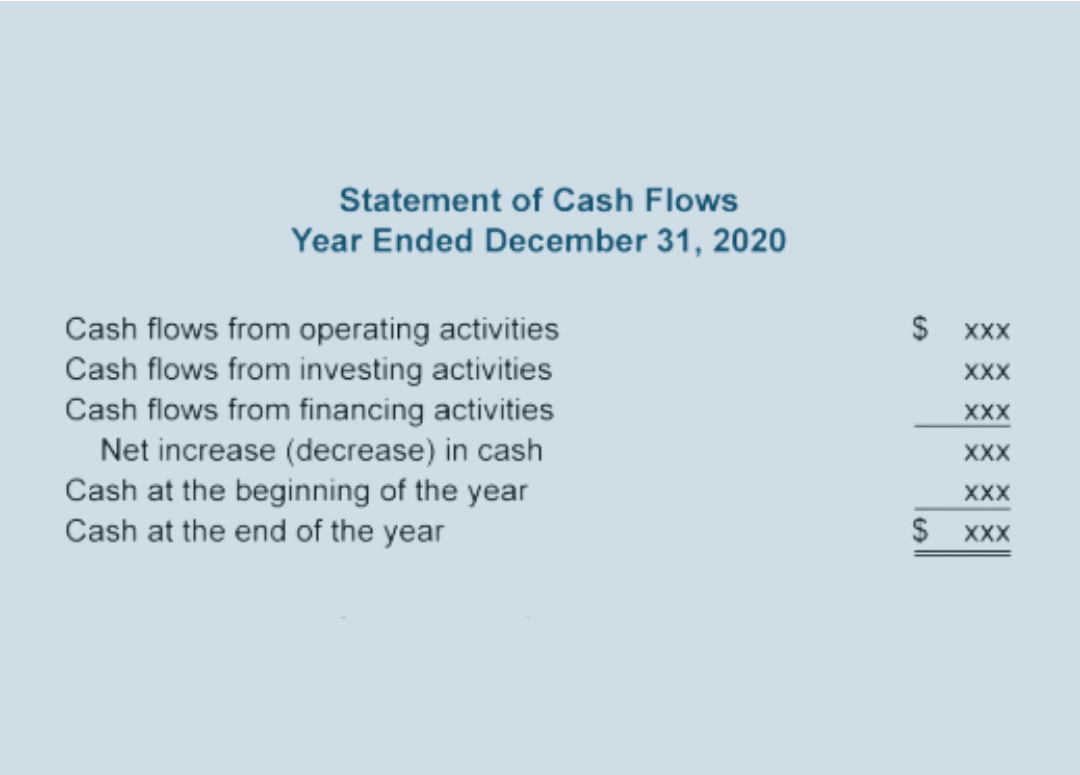

- Use the Cash Flow Statement – This report provides a clearer picture of available cash. Learn how to read a statement of cash flows here.

- Track Operating, Investing, & Financing Activities – Understanding these three components helps clarify cash flow trends.

- Implement Strong Financial Reporting – Work with a CFO or financial expert to regularly review your cash position.

Avoiding these common cash flow mistakes requires a proactive approach. By implementing better forecasting, maintaining a reserve, and improving collections, you can strengthen your business’s financial health.

Need help optimizing your cash flow? GrowthLab specializes in

Finance-as-a-Service (FaaS), providing

fractional CFO services, FP&A, and accounting to help businesses manage and improve their financial operations.

Get in touch with our team today!

Frequently Asked Questions About Cash Flow Management

What is the difference between cash flow and profit?

Profit is what remains after all expenses are deducted from revenue, while cash flow refers to the actual movement of money in and out of your business. A company can be profitable but still struggle with cash flow due to timing differences in payments received and expenses paid.

How often should I update my cash flow forecast?

It’s recommended to update your cash flow forecast weekly or biweekly, especially for businesses with fluctuating income and expenses. A 13-week cash flow forecast is a great way to stay ahead of potential shortfalls. See our guide on 13-week cash flow planning.

How much cash reserve should my business have?

A healthy business should aim to keep 3-6 months’ worth of operating expenses in a cash reserve. This ensures that unexpected expenses, economic downturns, or delayed customer payments won’t put your business at risk.

What are some tools to improve accounts receivable management?

Using automated invoicing software like QuickBooks, Xero, or NetSuite can help streamline collections. Additionally, setting clear payment terms, offering early payment discounts, and implementing a follow-up system for overdue invoices can significantly improve cash flow. Check out our accounts receivable tips.

Why do small businesses struggle with cash flow even when they’re profitable?

Cash flow struggles often happen due to delayed payments, unexpected expenses, poor financial planning, or rapid business growth. Many business owners also confuse profit with available cash, leading to budgeting mistakes. To avoid this, track cash flow statements regularly and ensure there’s always a cash buffer in place.

How can a CFO help improve my business’s cash flow?

A CFO can help by analyzing cash flow trends, improving forecasting models, optimizing expense management, and implementing stronger accounts receivable processes. If your business needs financial guidance, consider working with a fractional CFO. Learn more about fractional CFO services here.