How to Budget for Employee Benefits

Employee benefits are a crucial component of any small business's compensation package. They not only attract top talent but also foster employee satisfaction and loyalty. Navigating the complexities of budgeting for employee benefits can be daunting, especially for small business owners with limited resources. Let’s break down the process of budgeting for employee benefits step-by-step, helping you create a comprehensive plan that aligns with your financial goals and the needs of your employees.

Before diving into budgeting for employee benefits, it's essential to assess your current financial situation. Review your revenue, expenses, and cash flow to determine how much you can allocate towards employee benefits without compromising your business's financial stability. Consider factors such as business growth projections, market trends, and potential regulatory changes that may impact your budget.

Best Practices for Budgeting for Employee Benefits

Know Your Employee Benefit Needs/Preferences

Every workforce is unique, and the benefits that appeal to one group of employees may not necessarily resonate with another. Take the time to understand your employees' needs, preferences, and demographics. Conduct surveys, interviews, or focus groups to gather feedback on the types of benefits they value most, whether it's health insurance,

retirement plans, flexible work arrangements, or professional development opportunities.

Need Help Budgeting?

Download our FREE Budget for Employee Benefits

Know Your Benefit Options

Once you have a clear understanding of your financial constraints and employee preferences, research different benefit options available to small businesses. When comparing providers, evaluate these key factors:

- Cost: Total premiums and employer contribution requirements.

- Coverage: The depth and breadth of the services provided.

- Flexibility: How easily the plan can scale as your business grows.

- Administration: The time and effort required to manage the plan internally.

We collaborate with top-tier providers like

Human Interest to ensure comprehensive retirement benefits and efficient payroll management.

Prioritize Benefits

Not all benefits are created equal, and you may need to prioritize certain benefits over others based on your budget and employee needs. Focus on offering benefits that provide the most value to your employees while staying within your financial constraints. Health insurance and retirement plans are typically top priorities for many employees, but don't overlook other benefits like paid time off, wellness programs, or tuition reimbursement.

How to Create a Budget

With a clear understanding of your financial situation, employee needs, and benefit options, follow these steps to build your budget:

- Allocate Funds: Assign specific dollar amounts to each benefit category based on your established priorities.

- Account for Recurring Costs: Include ongoing expenses like monthly insurance premiums and employer 401(k) matches.

- Factor in One-Time Fees: Don't forget implementation, setup, or annual enrollment fees.

- Review Utilization: Track how many employees actually use the benefits to ensure your spend is effective.

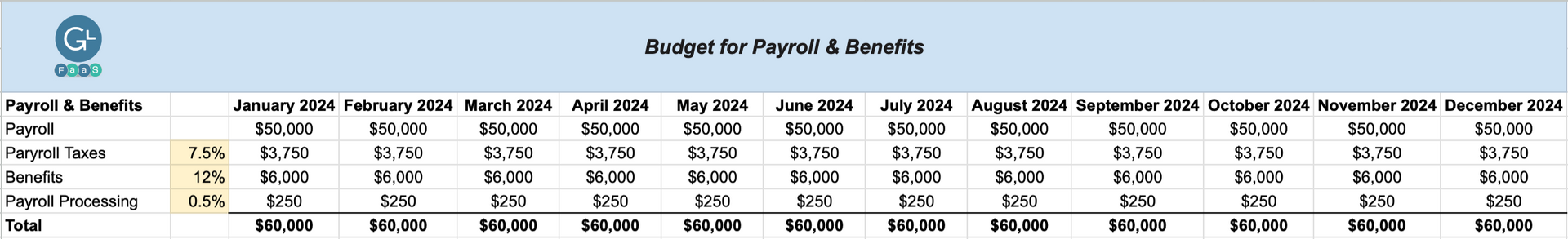

Budgeting for employee benefits is not a one-time task but an ongoing process that requires regular monitoring and adjustment. Keep track of your expenses, employee utilization, and market trends to ensure your budget remains aligned with your business goals and employee needs. Be prepared to make changes as necessary, whether it's reallocating funds, negotiating with vendors, or revising benefit offerings to better meet evolving needs. Our Financial Planning & Analysis team created this simple plug and play budget for your business to use to help budget for employee benefits.

Conclusion

Budgeting for employee benefits is a critical aspect of managing a small business. By following the steps outlined in this guide, you can create a clean, comprehensive budget that provides valuable benefits to your employees while supporting your business's financial health and growth.

Remember to prioritize employee needs, seek available options, and remain flexible in your approach to budgeting. With careful planning and strategic decision-making, you can build a benefits package that attracts and retains top talent, driving success for your small business in the long run.

Frequently Asked Questions About Employee Benefits

What are the typical costs associated with offering benefits to employees?

The costs associated with offering benefits to employees can vary widely depending on the types of benefits provided and the size of the workforce. Common costs include premiums for health, dental, vision, and life insurance plans, which are typically shared between the employer and employees. Retirement benefits, such as contributions to 401(k) plans or pension programs, also incur costs for employers, though these may vary based on factors like matching contributions or administrative fees.

How much should I budget for employee benefits as a small business?

As a small business, budgeting for employee benefits requires a balance between providing competitive benefits and maintaining financial stability. While there's no one-size-fits-all answer, allocating around 15-20% of total employee compensation costs towards benefits is a common guideline. This percentage can vary depending on factors such as industry norms, the size of your workforce, and the benefits you choose to offer.

How can I control costs while still offering competitive benefits?

One effective strategy is to carefully evaluate benefit options and negotiate with providers to secure the best possible rates. Additionally, implementing cost-sharing measures, such as asking employees to contribute towards their health insurance premiums or retirement plans, can help offset expenses while still providing valuable benefits.

Are there any tax incentives or credits available for offering employee benefits?

Yes, there are several tax incentives and credits available for businesses that offer employee benefits. For instance, contributions to employee retirement plans, such as 401(k) or IRA plans, are typically tax-deductible for employers, reducing their taxable income. Additionally, businesses may qualify for tax credits when offering certain types of benefits.

*This is not tax advice