Why Small Business Owners Should Stop Using Excel for Bookkeeping

When it comes to bookkeeping, Microsoft Excel might seem like a go-to solution. It's familiar, offers a range of formulas, and even provides templates that make it easier to manage your finances. However, relying on Excel for bookkeeping can actually hinder your business in the long run. If Excel is your default choice, it's worth considering more robust alternatives.

Lack of Historical Data

Excel wasn’t designed to store extensive financial data over long periods. Using it for bookkeeping means you won’t have access to the financial history necessary to identify trends and patterns. Without these insights, forecasting,

budgeting, and making informed business decisions become challenging. Moreover, a lack of comprehensive historical data can pose significant legal risks during an IRS audit.

Manual Entry and Errors

Excel requires manual data entry for bookkeeping, which is time-consuming and prone to errors. For small business owners, time is one of the most valuable resources. Spending hours managing Excel spreadsheets detracts from the time you could be using to grow your business. With more advanced bookkeeping software or GrowthLab’s support, you can reduce the time, cost, and error rate associated with manual bookkeeping.

No Integration with Other Tools

Most businesses use various tools that relate to finances, such as credit card and bank accounts, inventory tracking, online stores, and sales data. Unfortunately, Excel doesn’t integrate seamlessly with these tools. You’re forced to manually input data or download statements in Excel format to import them. This process is not only tedious but also increases the risk of errors, further complicating your bookkeeping efforts.

Check out our blog on the Benefits of a Virtual Bookkeeper.

Challenges in Scaling

While Excel might suffice when your business is just starting, it quickly becomes inadequate as your business grows. Adding new products or services, hiring more employees, adjusting prices, or securing additional financing all complicate your bookkeeping needs. Excel is not built to handle the complexities of a growing business, making it a poor choice for long-term bookkeeping solutions.

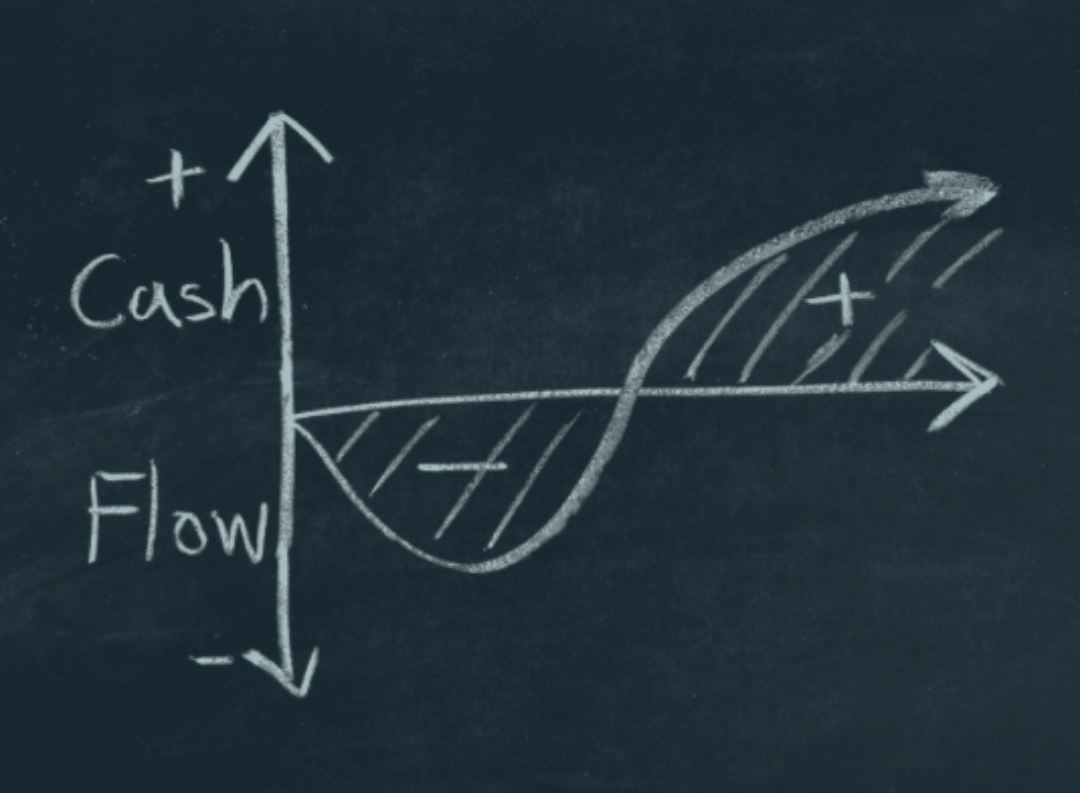

Inaccurate Cash Flow Projections

Managing

cash flow is crucial for the survival of any small business. However, many who rely on Excel for bookkeeping struggle with accurate cash flow forecasting. Unlike more advanced bookkeeping platforms, Excel lacks reliable tools for cash flow projection. Poor cash flow management is one of the leading reasons small businesses fail, making this a significant drawback of using Excel.

For small business owners looking to streamline their bookkeeping and ensure accurate financial management, it’s time to move beyond Excel. Advanced bookkeeping software or professional services like those offered by GrowthLab can provide the tools and support needed to manage your finances effectively, allowing you to focus on growing your business.

Frequently Asked Questions About Excel for Accounting

Can Excel replace accounting software for small businesses?

While Excel can handle basic accounting tasks, it may not fully replace dedicated accounting software, especially as your business grows. Excel requires manual data entry and lacks automation features like bank reconciliation, tax calculations, and compliance reporting, which are standard in accounting software. For small businesses with simple needs, Excel might suffice, but for more complex accounting, software like QuickBooks or Xero is recommended.

What are some tips for using Excel efficiently in small business accounting?

Tips include:

- Use templates to save time on repetitive tasks.

- Leverage Excel formulas to automate calculations.

- Apply data validation to reduce errors in data entry.

- Use pivot tables to summarize and analyze large amounts of data quickly.

- Regularly back up your Excel files to prevent data loss.

How do I create a balance sheet in Excel?

To create a balance sheet in Excel:

- Set up columns for assets, liabilities, and equity.

- List all assets (e.g., cash, inventory) and total them.

- List all liabilities (e.g., loans, accounts payable) and total them.

- Calculate equity by subtracting liabilities from assets.

- Use formulas to ensure that the balance sheet balances (assets = liabilities + equity).

Can I use Excel in combination with accounting software?

Yes, you can use Excel in combination with accounting software. Many businesses use Excel for specific tasks like data analysis, custom reports, or importing/exporting data to/from accounting software. However, the core accounting functions like bookkeeping, invoicing, and payroll are best managed within dedicated accounting software to ensure accuracy and efficiency.

What are the signs that Excel is no longer sufficient for my accounting needs?

Signs that Excel may no longer be sufficient include:

- Frequent errors due to manual data entry.

- Difficulty managing and tracking large volumes of data.

- Limited collaboration capabilities among team members.

- Time-consuming processes for generating reports.

- Inability to integrate with other business tools like CRM or inventory systems.

- Security concerns with sensitive financial data.

How can I tell if my business has outgrown Excel for accounting?

Your business has likely outgrown Excel for accounting if:

- You’re spending too much time on manual data entry and corrections.

- Your financial data is becoming unmanageable with Excel’s limitations.

- You need more sophisticated reporting than what Excel can provide.

- Your team requires simultaneous access to financial data.

- Security concerns arise due to the sensitivity and volume of your financial data.

- You’re missing out on automation, leading to inefficiencies.

Other Blogs Related to Small Business Accounting