About the Employee Retention Tax Credit

Due to the pandemic, there are several payroll tax credits available to employers. One option is the Employee Retention Tax Credit (ERTC). At its core, the ERTC is a completely refundable tax credit that can reduce your tax burden as long as you keep your employees on payroll. Let’s take a closer look at what it is and how it works.

How Much is the ERTC?

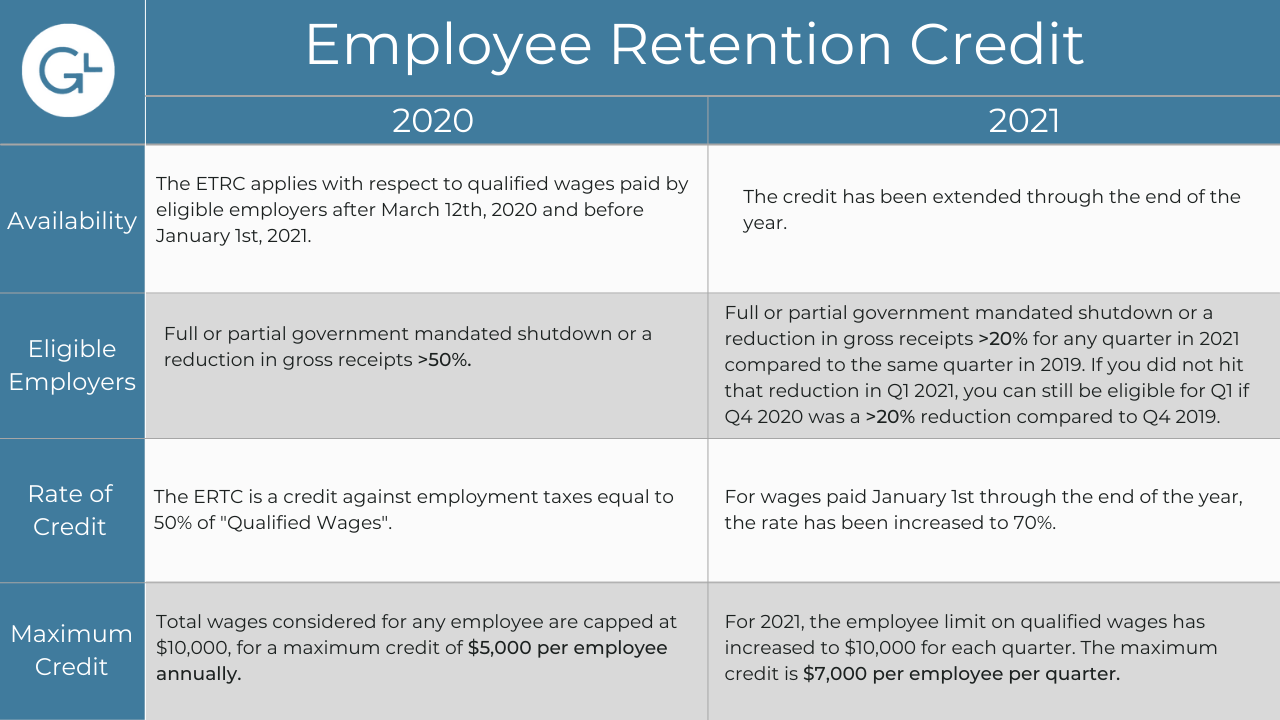

When it was initially signed into law under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the ERTC was equal to 50% of qualified wages eligible employers paid between March 13th 2020 and December 31st 2020.

Then, the Consolidated Appropriations Act (CAA) expanded the ERTC a bit. In addition to the 2020 benefit, it extended eligibility through Q1 and Q2 of 2021 and increased the credit to 70% of qualified wages, still up to $10,000 per employee, but now per quarter for Q1 and Q2 of 2021 (max benefit of $7,000 per employee per quarter).

Most recently, the American Rescue Plan Act (ARPA) further extended the ERTC to cover all of 2021, with the same $7,000 cap per employee per quarter (2021 max of $28,000 per employee).

If you don’t qualify for the credit under the quarterly revenue reduction clause but do because of the full or partial government mandated shutdown, the credit is equal to the amount of qualified wages during the time period operations were shut down.

How Do I Claim the ERTC?

For past quarters that the corresponding Form 941 has already been filed, you can claim the ERTC on your federal tax returns through Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return. Most payroll providers should be able to process them.

To claim the credit for the current and subsequent quarters, you’ll need to fill out

Form 7200, Advance Payment of Employer Credits Due to COVID-19. It’s important to do so before the end of the month after the quarter in which you paid the qualified wages, or before Form 941 is due for that quarter. You can file Form 7200 any time until August 2nd, 2021.

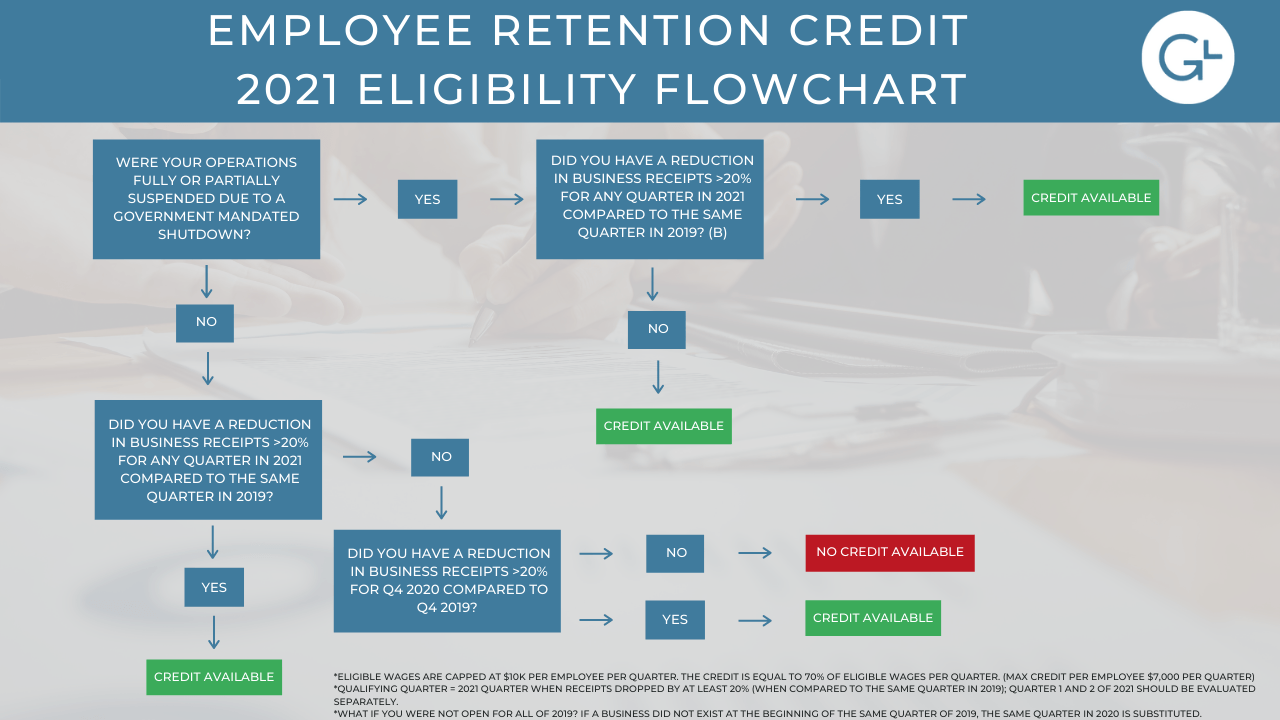

Am I Eligible for the ERTC?

If you’d like to take advantage of the ERTC, you must be an employer who has had to fully or partially stop operations because of a COVID-19 government order or faced a substantial decline of at least 50% in gross receipts in Q2, Q3, or Q4 of 2020. To see if you are eligible for Q1 or Q2 in 2021, the quarterly decline needs to be at least 20% compared to the same quarter in 2019. But, there is a special rule for the 2021 ERTC that allows the business to look to the previous quarter to determine that 20% decline. For example, during Q1 of 2021, Q4 of 2020 revenue could be used (compared to Q4 2019). This special rule would be used if Q1 2021 revenue had not declined more than 20% from Q1 2019 revenue.

Thanks to the American Rescue Plan, you may also pursue the credit if you’re a startup that was established before February 15th 2020 with annual gross receipts of up to $1 million. The ERTC is also an option for you if you’ve experienced a revenue decline of 90% or more, compared to the same quarter of the past year.

For some clarification on what qualifies as a “full or partial government mandated shutdown” which is still largely a gray area, and many more helpful FAQs, see the IRS Notice 20-21.

Can I Claim the ERTC and the PPP?

At first, the CARES Act did not allow employers who received the PPP loan to take advantage of the ERTC. Under the CAA, however, you can now claim the credit for any wages paid beyond the proceeds of your PPP loan that have been forgiven. So, if you received a PPP loan in 2020 but paid eligible wages beyond the wages that were forgiven as part of the PPP, you can still benefit from the credit.

Interested in the ERTC for Your Business? Contact GrowthLab Today

Other Blogs Related to Tax