What is New for the R&D Tax Credit and Expenses

You may have heard of the Research & Development (R&D) or (R&E) Tax Credit before. It was a great way for startups that spend on product development to save money. Businesses could qualify with research activities such as, developing new/improving products or experimenting with new technologies/improving existing ones.

What’s Changed in the R&D Tax Law for 2022?

The Federal 2017 tax reform act enacted changes to Section 174 (Research and Experimental) applicable for tax years beginning after 2021. The 2017 tax reform act is effective for amounts paid or incurred in the tax years after December 31, 2021, to eliminate current-year deductibility of Research and Experimental (R&E) expenditures and software development costs.

The act requires companies to charge R&E expenditures to a capital account over five years. Expenditures performed outside the US are charged to a capital account over 15 years. Companies will still be permitted to take R&D credit for expenses incurred in the US. The net effect companies will lose deductions in the current year.

Prior to the passage of the Tax Cuts and Jobs Act in 2017, companies may have claimed IRS Section 174 (R&E) expenses as ordinary and necessary costs in the year expensed. The Act changed that rule. The overall value of R&D credit remains the same, but businesses must take longer to write off the expenses. If the research is abandoned after the company starts to take the amortization the company is not permitted to take the balance as a write-off in the year of abandonment.

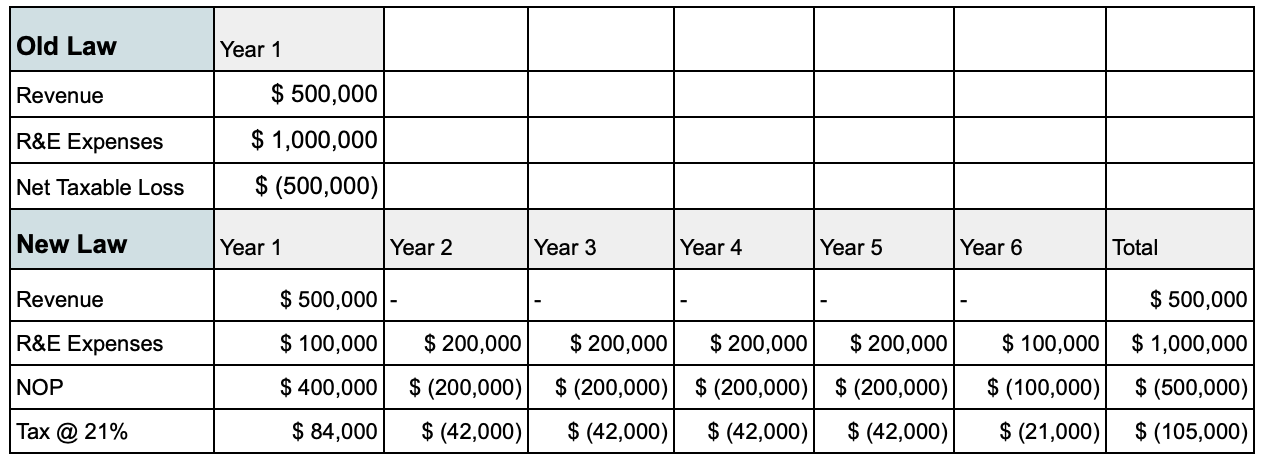

2022 R&D Tax Example

The Tax is paid in the initial year. The losses of $900,000 are carryforward and only can be used when the company has a profit. There are specific net operating loss rules as to how much of the loss can be used in a profit year. The above example does not discuss State taxes.

R&D Expenses capitalized over 5 years, in year 1 the company can take only 10%, in year 6 the balance of 10%.

The threshold for state income taxes is whether and how a state conforms to the IRS Code. States begin the determination of State taxable income with federal taxable income generally done in three distinct ways, each of which brings in unique state income tax consequences. How a particular state adopts the IRS code directly affects the application of enacted federal changes to its taxable income computation.

In summary, in the initial year (possible ongoing) Companies will see higher taxable income in the current year. The results are that within six years the company breaks even. Effectively, the company is paying higher taxes upfront.

Unsure How to Navigate These Changes?

Reach out to us with any questions you may have about the R&D Tax Credit changes. Also, check out TaxTakers blog with more resources on how you can qualify for the R&D tax credit. Once you determine if you qualify, you can apply for an R&D tax credit with the help of TaxTaker.