Long Range Planning

If you’re a small business owner, planning for your future is important. That’s where a long range plan comes in. No matter your industry, a long range plan can help you meet your long-term goals and reach your full potential. Let’s dive deeper into the ins and outs of long range planning so you can determine how it may apply to your unique business.

What is Long Range Planning?

Put simply, a long range plan is a roadmap that can help your business meet its growth goals. It usually spans a 3 to 5 year period and strives to align long-term objectives or a part of the mission statement with action plans. Depending on the main purpose of the long-range plan, it may have a fixed or rolling deadline.

A long range plan typically requires the support from various stakeholders in your business, such as those involved in

finance, operations, sales, marketing, and manufacturing. All of these stakeholders work together to convert goals into an execution plan that allocates specific tasks to certain resources.

Long Range Planning vs. Strategic Planning

Strategic planning is a process your business may use to pinpoint long-term goals after you carefully evaluate where you’re at and where you hope to be in the future. The final strategic plan is typically made up of non-actionable goals. Long range planning is designed to turn the strategic plan into actionable steps that steer you toward success.

It helps execute strategic planning. While both strategic planning and long range term planning require a significant monetary and time investment, they’re often well worth it. As long as these initiatives are well thought out and properly implemented, they can lead to a variety of benefits for your business, such as goal achievement, growth, and employee satisfaction.

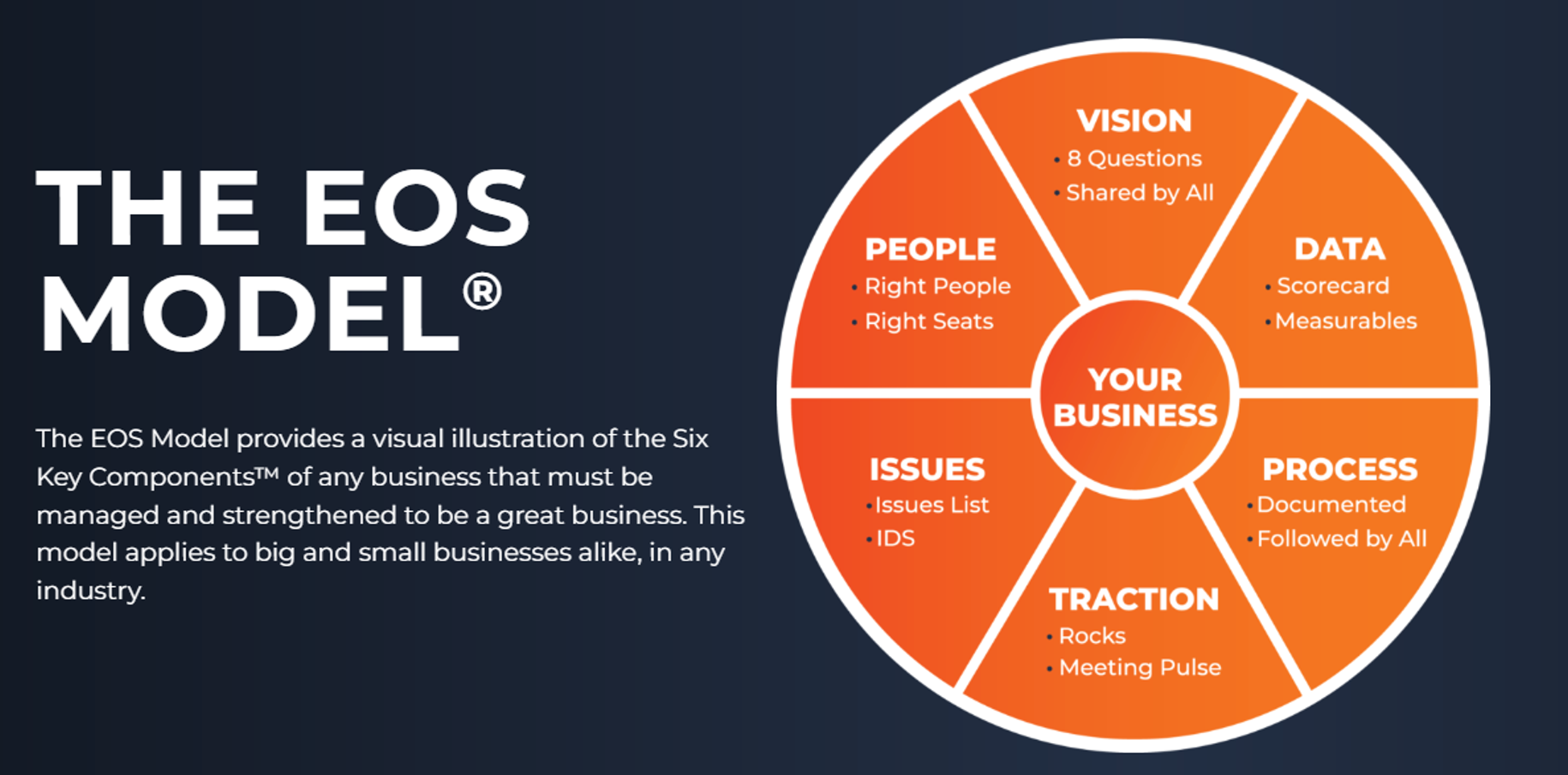

Key Elements in the Long-Range Planning Process

No two long range plans are created equal. After all, every business has their own unique goals and plans on how to meet them. However, most long range plans involve several important components including:

Mission: A mission statement explains your purpose and how you serve your customers, employees, and others.

Vision: You can think of a vision statement as the “why” of your business. It focuses on who you intend to be down the road.

SWOT Analysis: A SWOT analysis explores strengths, weaknesses, opportunities, and threats. It can help you determine what you can improve and what you should avoid.

Sales and Operational Goals: With a thorough understanding of sales and operational goals, you may identify initiatives or activities that boost revenue and profits to maximize performance.

How to Create a Long-Range Plan

There’s no set process for long range planning. Every business may have their own particular way of going about it. However, many organizations take all of or some of these steps:

- Reflect on the Mission: First and foremost, it’s a good idea to meet with key stakeholders so you can discuss your mission and what it means to you. Let’s say your mission involves serving customers with environmentally friendly products. This can give your company something to focus on as you build a logical, long-range plan.

- Create Actionable Goals: Once you choose the part of your mission you’d like to focus on, you can determine the actionable goals that cater to it as well as deadlines for each of them. The goals you set will serve as a backbone of your long-range plan. If your mission relates to green products, one of your goals may be to design green packaging to go along with them. Remember that your goals are not set in stone and sure to change or evolve over time.

- Identify Operational Procedures: The next step is to come up with a plan that will enable your organization to achieve your goals by your desired deadlines. In most cases, your plan will begin at the leadership level and involve the CEO and management team. As soon as they decide how each individual department will contribute to the goals, team managers can create department focused operational plans to help meet them. In the green packaging example, the manufacturing team might have a plan to create the ideal prototypes while the marketing team’s plan is based on new social media or print marketing campaigns.

- Adjust the Plan as Needed: A long range plan typically takes anywhere from 5 to 10 years to complete. Therefore, there’s a good chance it will require some revisions. If you notice changes in technology, supply chain, and customer demand, for example, don’t be afraid to adjust your plan accordingly. It’s in your best interest to schedule regular meetings to discuss progress and determine whether any modifications are necessary.

Best Long-Range Planning Tools

Although you don't need to have these tools to create a long-range plan. These tools will set you up for success.

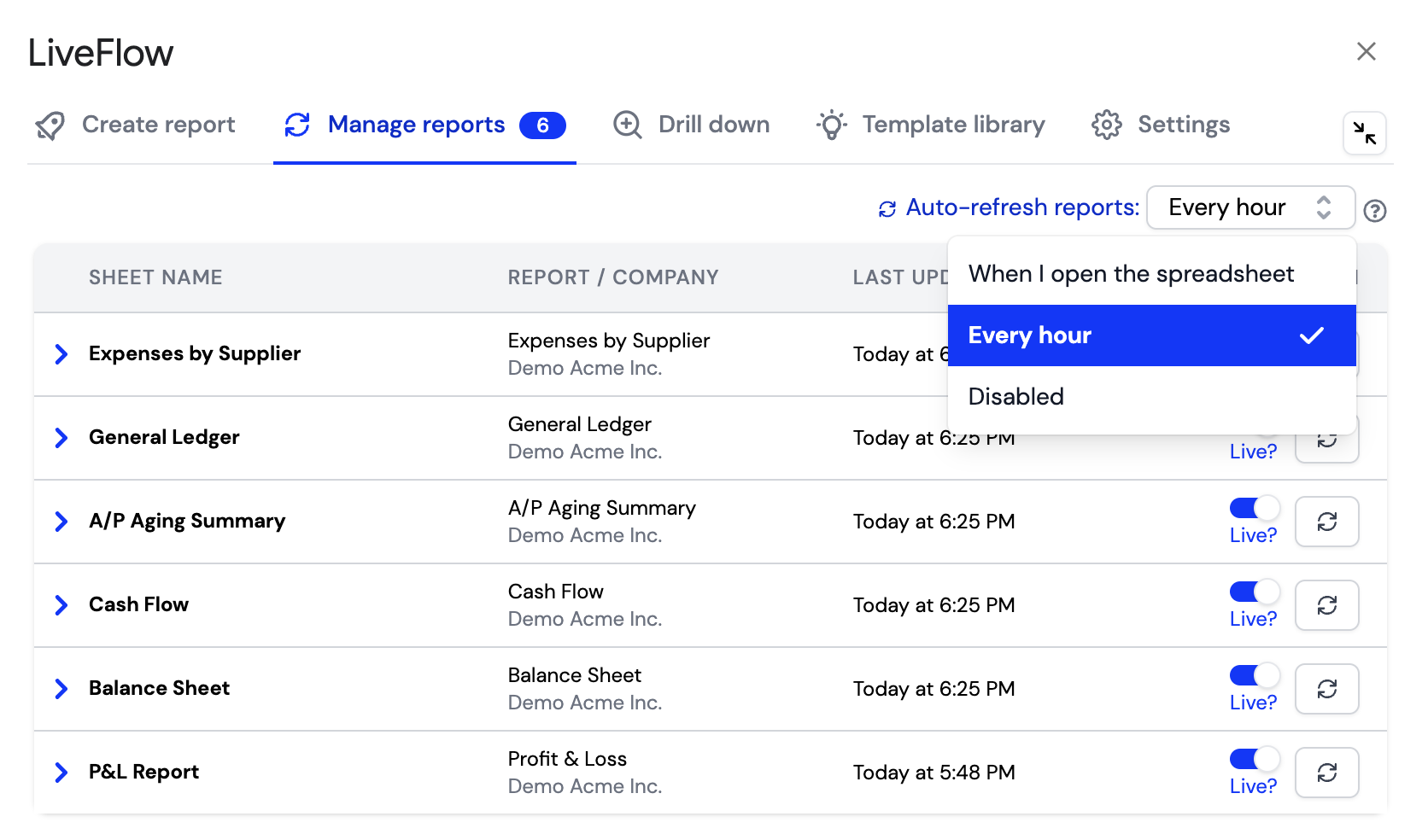

LiveFlow

LiveFlow makes financial analysis and planning easy with automatic structured exports of your financial reports. If you're looking to build or update a model, but are not ready to move to a full planning platform, we recommend you start with

Liveflow. Liveflow will automate the syncing of your QuickBooks data into Google Sheets following your monthly close process, making your modeling streamlined, accurate, and more efficient.

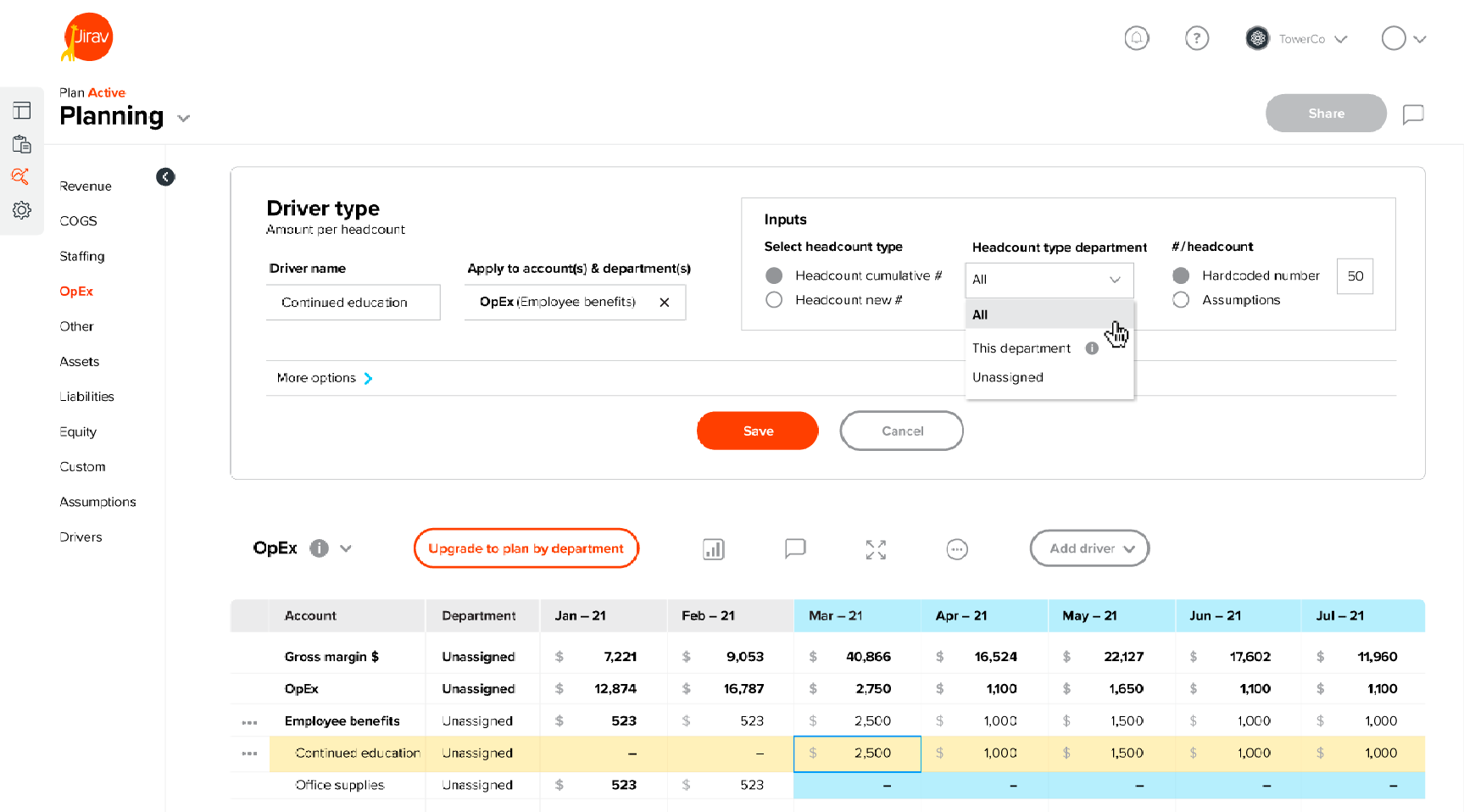

Jirav

When you're ready to move to a full-fledged modeling platform, one of the many options we like is Jirav. Their platform will help you create full financial forecasts for yourself or for your clients. Jirav will also support the reporting and dashboard visuals following the close of each month to help you deliver any analysis you may be looking for. On top of this, Jirav syncs with a handful of HR platforms to help pull in HR data that you may wish to use to structure your model.

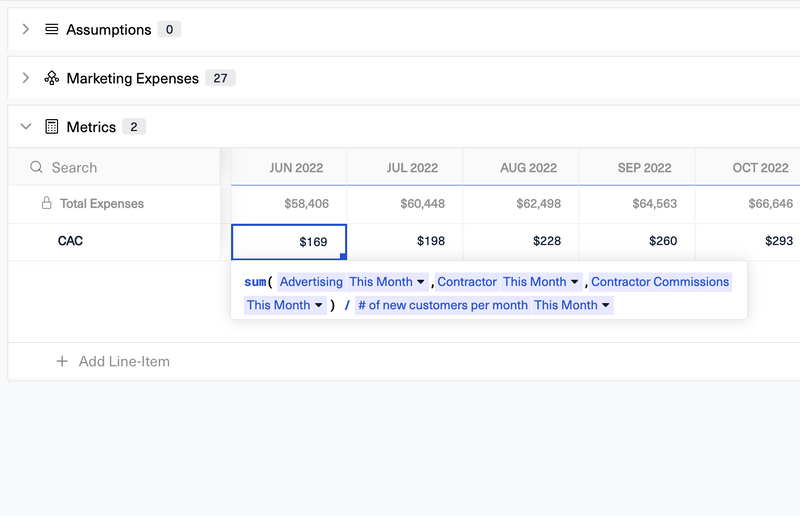

Basis

Another full modeling platform we love is

Basis. Basis not only syncs with your general ledger, but also has a ton of integrations within the HR, PEO, CRM and ERP space. This allows another level of business data to be imported in real time into your model for deep analysis. The output of this data within their reporting and dashboards allow for both financial and business analysis within the platform.

Bottom Line

If you’d like to ensure a successful future for your business or clients, long range planning is not an option... it’s a necessity. In fact, it may be just what you need to harness the power of your current strengths and resources and enjoy a thriving organization for years to come. Through critical thinking, sound strategy, and timely execution, you’ll be able to scale your venture and meet (or even exceed) your long-term goals.

Frequently Asked Questions About Long Range Planning

How does long-range financial planning differ from short-term planning?

Short-term planning focuses on immediate financial goals, usually within a year, such as managing cash flow or meeting quarterly targets. Long-range planning, on the other hand, looks at broader objectives over several years, including expansion, large investments, and strategic shifts, requiring more in-depth analysis and forecasting.

How can companies effectively implement long-range financial plans?

Companies can implement long-range financial plans by establishing clear objectives, regularly reviewing and updating the plan, involving key stakeholders, using financial modeling tools, and monitoring performance against long-term goals. Effective communication and flexibility to adapt to changes are also essential.

How does long-range planning impact business valuation?

Long-range planning can positively impact business valuation by demonstrating the company’s potential for sustained growth, strategic foresight, and financial stability. It provides investors and stakeholders with confidence in the business’s future prospects, often leading to higher valuation multiples.

What is the difference between budgeting and long-range planning?

Budgeting is typically a short-term financial plan that covers a one-year period, focusing on income, expenses, and cash flow management. Long-range planning, however, looks at the bigger picture over several years, involving strategic goals, investments, and growth initiatives that go beyond the annual budget.

How often should long-range financial plans be reviewed?

Long-range financial plans should be reviewed at least annually or whenever there are significant changes in the business environment, such as economic shifts, market trends, or internal developments. Regular reviews help ensure that the plan remains relevant and aligned with the company’s strategic goals.

What is the role of a CFO in long-range financial planning?

The CFO plays a pivotal role in long-range financial planning by leading the development of the plan, ensuring alignment with corporate strategy, managing financial risks, and providing insights based on financial data. The CFO also collaborates with other executives to ensure that long-term financial goals are integrated into the overall business strategy.

Other Blogs Related to Finance-as-a-Service

GrowthLab, a Finance-as-a-Service (FaaS) company serving founders and management teams with full-service Financial Planning & Analysis, Monthly Accounting, Virtual CFO, HR-People Advisory, and Business Tax.