What is Grant Accounting?

If your organization depends on grants, grant accounting should be on your radar. It can help you track grant-related revenue and expenses so that you fulfill your mission and maintain excellent relationships with donors, stakeholders, and others who are important to you. Some people may call it nonprofit account, but this applies for non dilutive equity providers, university transfer office companies, SBIR grants (NIH, DOD, DOE, etc.), and other for profit organizations.

What Does a Grant Accountant Do?

A grant accountant can keep your organization and everyday operations running smoothly. They oversee grant activities and may perform a variety of tasks such as:

- Create and enter budgets

- Create financial statements

- Entity level P&L

- Grant or program level P&L

- Assist with audits and assessments

- Prepare invoices for reimbursable expenses

- Payroll allocations by grant or program

- Manage restricted and unrestricted funds

- Reconcile grant projects and awards

The Application of Classes in Grant Accounting

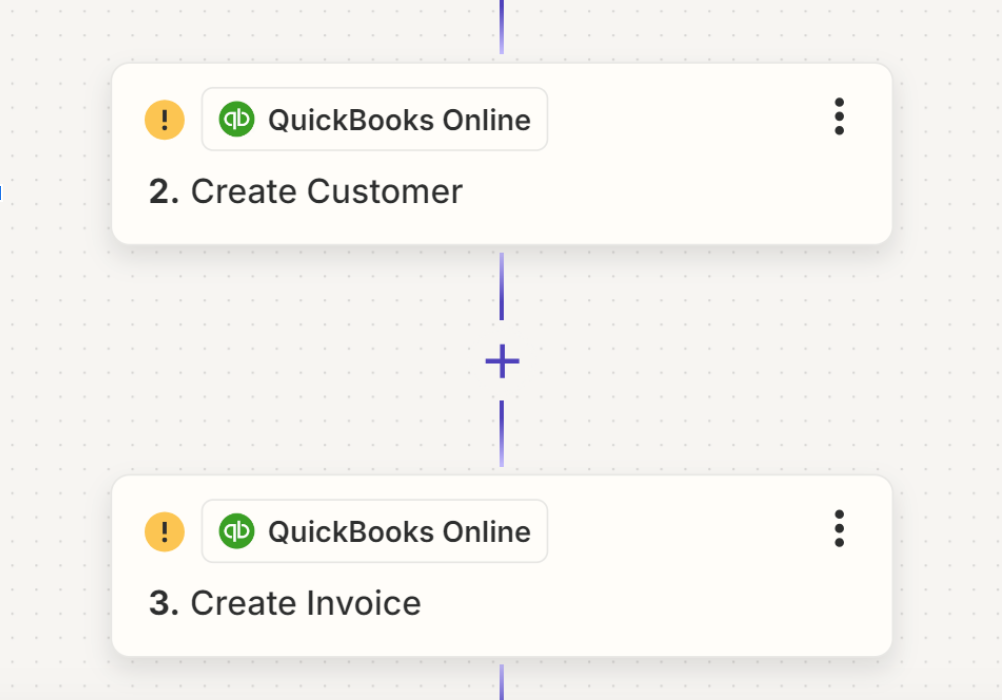

You can assign each transaction in

QuickBooks

to a class to track revenue and expenses for a specific program regardless of the chart of accounts. With classes, you may have one set of general ledger accounts and separate by classes based on specific programs, grants, or donors.

This

may

result in a shorter, less complicated chart of accounts - without loss of the underlying detail. In addition, QuickBooks allows an option to set up a budget for each grant. QuickBooks adds ease and efficiency to the grant tracking process, but can not replace a solid grant accountant.

What Types of Reports are Required for Grant Reporting?

There are a number of reports that are required for grant reporting. These include:

- Financial statements or financial reports - restricted versus unrestricted

- Grant specific financial statements

- Program level activities

- Results and impact details

- Future plans and sustainability

Frequently Asked Questions

What does a grant accountant do?

A grant accountant manages all financial aspects of grant funding, including budgeting, financial reporting, payroll allocations, invoice preparation, audit support, and reconciling grant expenses to ensure compliance and accuracy.

Why is grant accounting important?

Grant accounting helps organizations remain compliant with funding requirements, maintain transparency, build trust with funders, make informed financial decisions, and support long-term sustainability.

Who needs grant accounting services?

Any organization that relies on grants should implement grant accounting.

How does QuickBooks support grant accounting?

QuickBooks allows organizations to assign transactions to specific classes, enabling tracking by grant, program, or donor. This simplifies financial reporting, reduces the complexity of the chart of accounts, and allows for grant-specific budgeting and reporting.

Other Blogs Related to Small Business Accounting