How to Use Automation to Close Books Effectively

We know the demands of bookkeeping and accounting for small and medium-sized businesses. Our commitment to accuracy, efficiency, and seamless financial management has driven us to embrace automation for effective book closings. Selecting the right accounting software with robust automation features is crucial for modernization. Tools like QuickBooks, Xero, STRMS, and Xenett are instrumental in automating various book closure tasks, from data entry to report generation.

Establishing Standardized Workflows

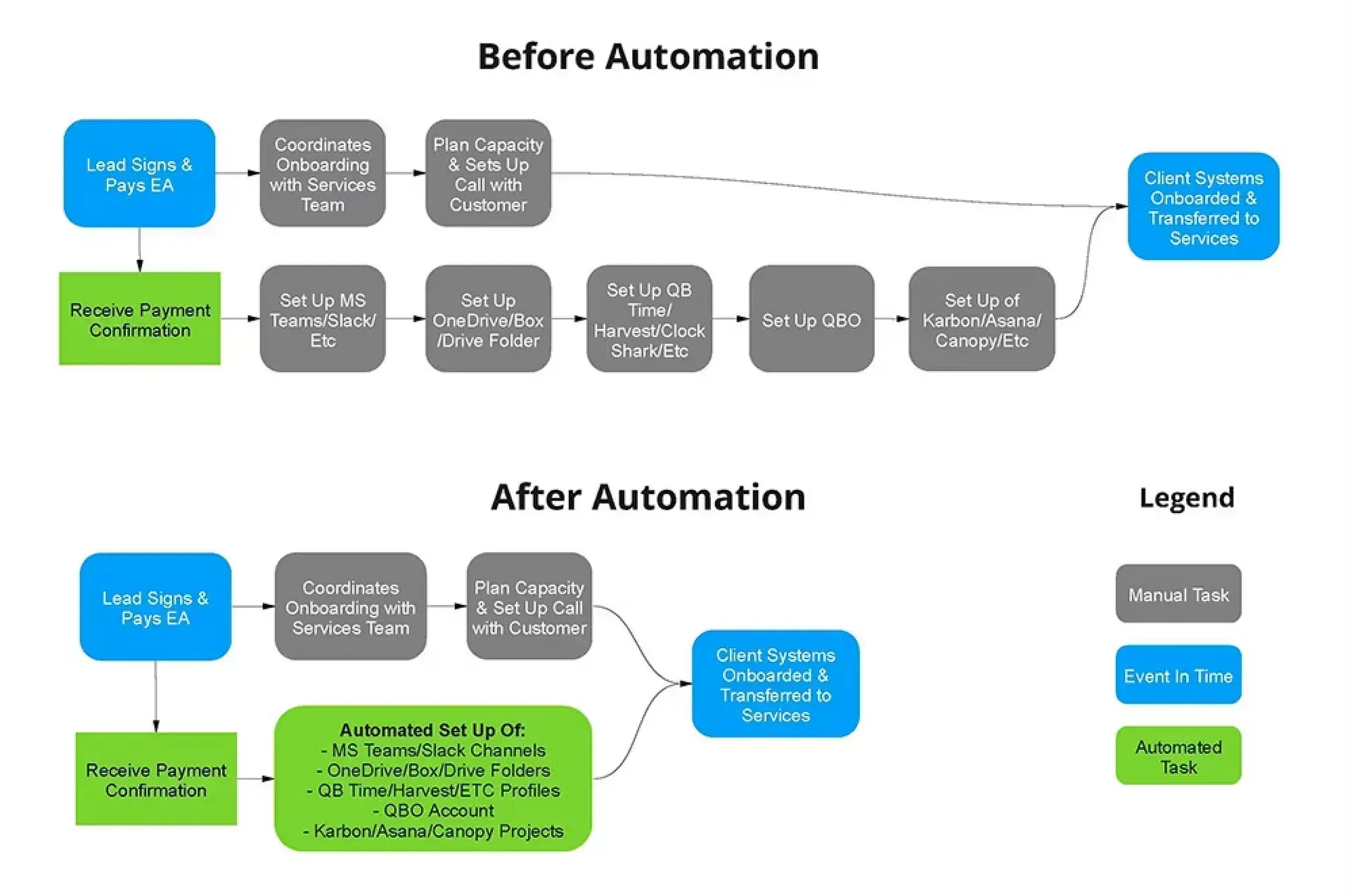

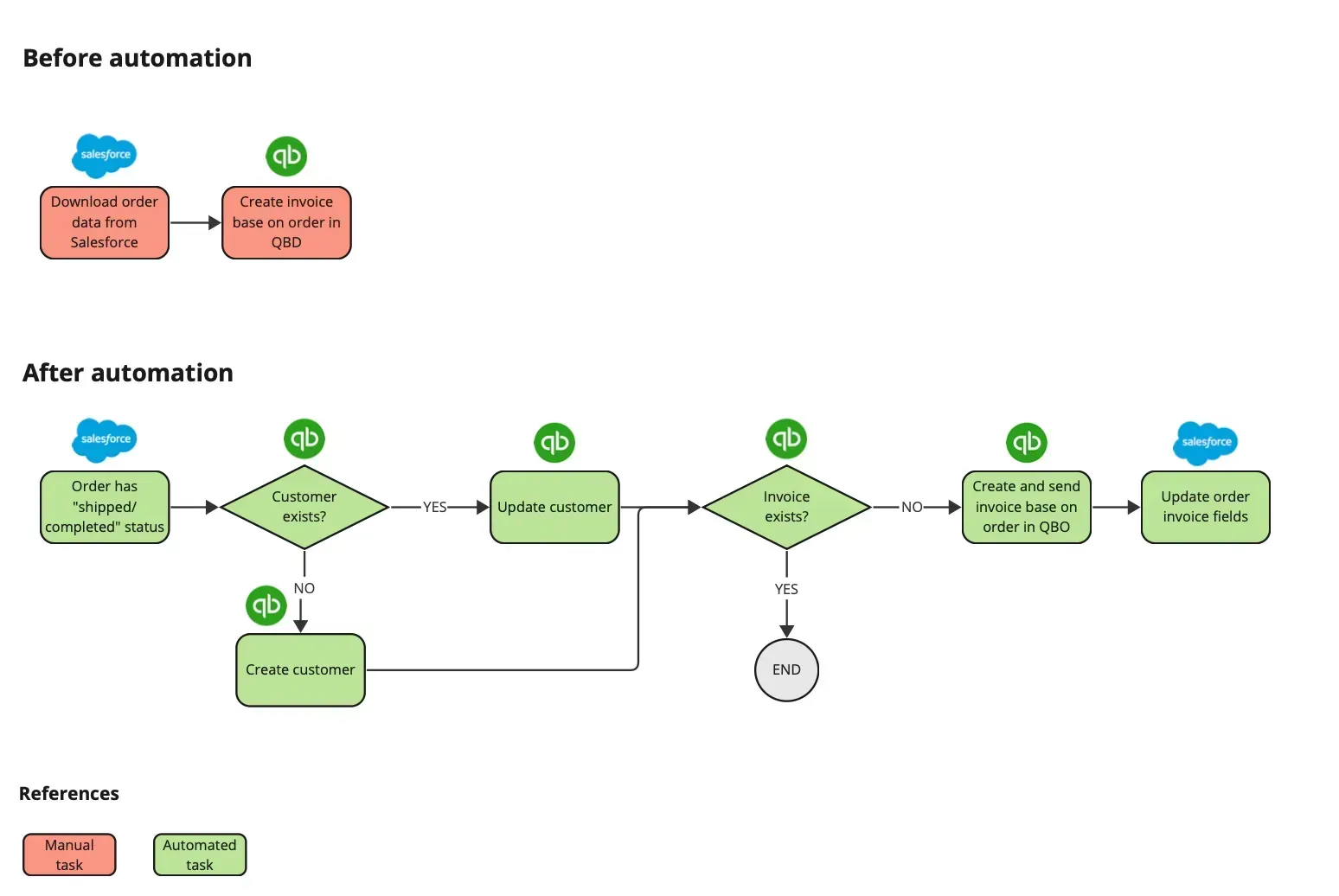

Our approach involves more than just using software; we've established standardized workflows for closing books. Documenting step-by-step procedures ensures all team members understand and follow these processes, providing a clear framework for automation implementation. STRMS helped us do this by creating a process map to visually represent the step-by-step sequence of activities - including which people, tools, software, and/or documents are involved. They taught us that before automating a process (like the tasks associated with closing a business book), it's crucial to understand it thoroughly. Process maps provide a clear blueprint for automating those repetitive tasks.

Here are some examples of STRMS Process Mapping:

Leveraging Xenett for Enhanced Book Closing

Enhanced

Book Closing:

Refers to the optimization of book closing procedures through the use of advanced tools and technologies to improve accuracy and efficiency.

Xenett, in particular, plays a pivotal role in our workflow, offering features that significantly enhance our book-closing process. For instance, we leverage Xenett to easily reclassify entries, streamlining the reclassification process. The platform allows us to view the last time accounts were reconciled and their balances, providing instant insights for efficient tracking.

Moreover, Xenett's ability to point out unreconciled entries and entries without essential details (such as customers, vendors, or classes) ensures thorough reconciliation and accuracy. The platform makes it easy for us to find new entities, facilitating comprehensive financial oversight.

One noteworthy feature is the capability to add comments directly to transactions, promoting clarity and seamless communication within the team. Additionally, Xenett's game-changing functionality allows us to add customers and classes to transactions in bulk, a significant time-saver compared to manual processes.

Efficiency and Precision in the Closing Process

The integration of Xenett into our bookkeeping and accounting practices has streamlined our operations, allowing us to achieve a level of efficiency and precision previously unattainable. By automating repetitive tasks and utilizing its error-detection capabilities, we've been able to focus more on strategic analysis and providing valuable financial insights to our clients.

Interested in Learning More?

Xenett pinpoints if coding is not consistent. It helps elevate our bookkeepers by showing them their errors and being able to fix them. Growing and continuous learning is an essential part of GrowthLab. It gives the leads more confidence in the work knowing Xenett was used in the reviewing process.

We're committed to staying at the forefront of technological advancements in the accounting industry. Automation isn't just a buzzword for us; it's a transformative tool that enables us to deliver exceptional services, ensuring our clients' financial health and success.

Dan Gertrudes

As CEO and Founder of GrowthLab Finance-as-a-Service (FaaS), Dan is the vision behind GrowthLab’s success. After spending 15 years at Fortune 500 and medium-sized companies, Dan transferred his knowledge into building GrowthLab, which now supports over 400 scaling businesses throughout their entire finance and HR value stream.

GrowthLab, a Finance-as-a-Service (FaaS) company serving founders and management teams with full-service Financial Planning & Analysis, Monthly Accounting, Virtual CFO, HR-People Advisory, and Business Tax.