SAFE Note and Convertible Note: The Differences

As a startup, you have several options for raising capital. Two of them include SAFE notes and convertible notes, both of which are good options for businesses that are in early stage development.

Both of these allow you to push the company valuation of your business to a later date so that you can grow the business (and support a higher valuation) before setting the valuation on which to sell equity. This, of course, helps you sell less equity because you increase the value per share before selling shares.

While SAFE notes and Convertible notes are similar in nature, several differences between them are important to understand. So how do SAFE notes and convertible notes work and which one is right for your business? Keep reading to find out.

What is a SAFE Note?

SAFEs or Simple Agreement for Future Equity notes were initially created in 2013 by Silicon Valley startup accelerator, Y Combinator (ADD BACKLINK). While SAFE notes have gained popularity in recent years and are designed to be converted to equity at a later date, they are not considered loans or debt instruments. Therefore, they don’t have an interest rate or predetermined maturity date. As a result, there is no pressure for your business to convert a SAFE note into equity at a particular date or during a round of fundraising.

You can think of SAFE notes as agreements or warranties, instead of traditional loans. They’re simplified versions of convertible notes (which we’ll discuss below) that don't include the interest and maturity components.

Types of SAFE Notes

SAFE notes fall into four categories based on whether the note includes or excludes two key factors: discount rate and valuation cap. The four types are as follows:

- Discount Included; Valuation Cap Included: This version is one of the more frequently used types because it offers two incentives for the SAFE investors. The investors are guaranteed to get extra value when the SAFE converts to equity. If the SAFE converts above the valuation cap, the SAFE investors buy in at the lower dollar per share established by the valuation cap. If the SAFE converts below the valuation cap or if the discount provides a better price, the SAFE investors buy in at the lower dollar per share established by the discount.

- No Discount; Valuation Cap Included: This version makes sense if you want to provide your investors with the benefit of a valuation cap, but do not want to include a discount option (which is used if the SAFE converts below the valuation cap).

- Discount Included; No Valuation Cap: This version of the SAFE note removes the valuation cap, but provide SAFE investors with a discount upon conversion. This is another way to guarantee that your SAFE investors get extra value upon conversion.

- No Valuation Cap; No Discount: This version is rare as it offers no incentive for investors and is, therefore, harder to sell. However, it is the best fit for the purpose of minimizing dilution.

Convertible notes may also include a valuation cap which sets the ceiling on the valuation of the company for purposes of conversion. Said another way, these investors set an upper limit on the price they are willing to pay for each share of the company.

SAFE Note vs Convertible Note

Similarities Between SAFEs and Convertible Notes

SAFE notes and convertible notes are designed to help early-stage businesses raise capital. These tools promise investors that they’ll receive additional shares of preferred stock down the road (unless you use a no cap, no discount SAFE). Eventually, both SAFE notes and conversion notes can be converted to equity and offer a discount and/or valuation cap.

Here’s a brief overview of how they both work: An investor agrees to give your business a certain amount of money today as an initial investment. In exchange, they receive the right to convert those funds into shares of your company. Typically, the monies convert at a better rate (aka, better dollar per share) than the new equity being sold.

Here’s a brief overview of how they both work: An investor agrees to give your business a certain amount of money today as an initial investment. In exchange, they receive the right to convert those funds into shares of your company. Typically, the monies convert at a better rate (aka, better dollar per share) than the new equity being sold.

Differences Between SAFEs and Convertible Notes

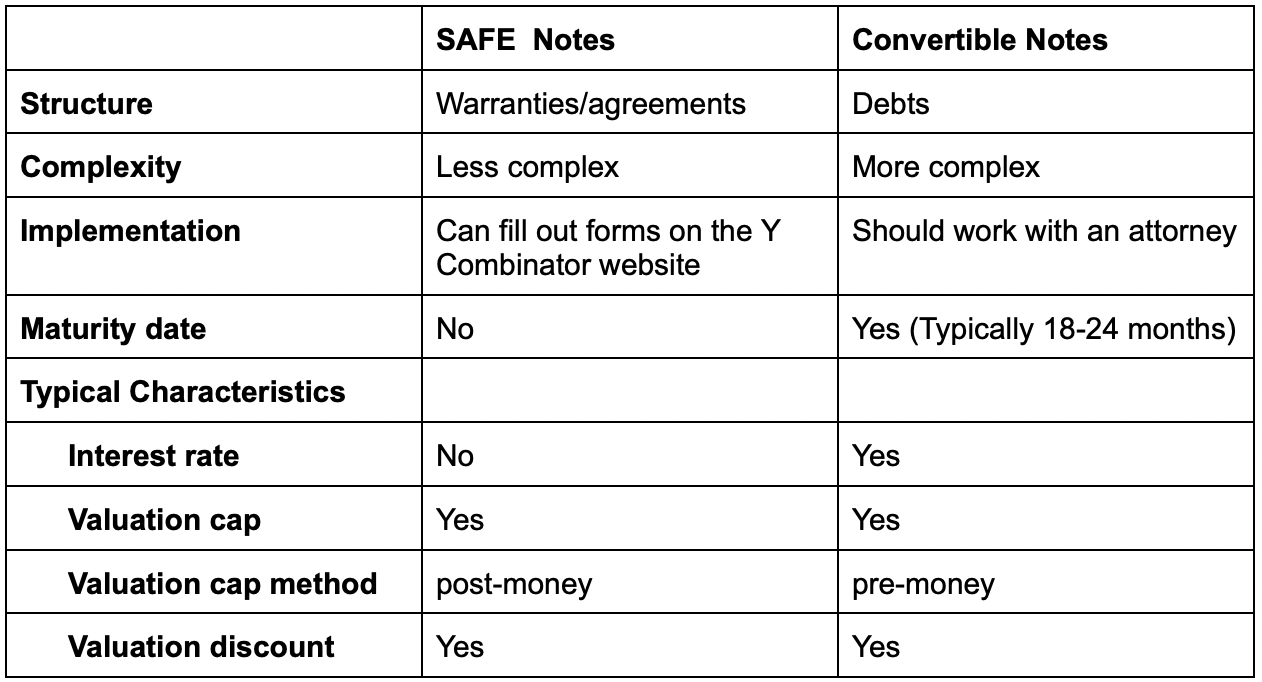

While SAFEs and convertible notes have similar functions, there are several noteworthy differences between them, including:

- Debt Classification: SAFE notes are not classified as debt instruments whereas convertible notes are. Put simply, convertible notes are loans that must be repaid through cash or company shares.

- Interest: Just like most debts, convertible notes come with interest charges. Your business will need to repay the principal plus interest. SAFE notes, however, don’t carry interest because they serve as agreements or warranties rather than debts.

- Timelines: Unlike SAFE notes, convertible notes have a maturity date. After about 18 to 24 months, a convertible note usually converts automatically or must be repaid. If your business doesn’t continue to raise money, SAFE notes can be held.

- Documentation: Compared to convertible notes, SAFE notes are usually shorter and more straightforward. This is because there are less terms and contingencies for your business and investors to agree on. In addition, convertible notes almost always require a separate note purchase agreement (to sign before monies are exchanged) while SAFEs do not typically require such pre-documentation.

- Flexibility: SAFEs are based on standardized templates you can find on Y Combinator’s website. Since convertible notes are not as standardized, they may allow for greater flexibility for your business and investors, but they also require more legal support to produce.

Legal and Tax Considerations for SAFE and Convertible Notes

Legal and tax aspects play vital roles in SAFE and convertible notes. Understanding the implications for both parties is crucial. Tax liabilities may differ based on the instrument and State. Legal fees could vary due to complexity. Conversion terms and triggering events impact tax implications. SAFE notes may have simpler tax treatments than convertible notes due to their nature. Always consult legal and tax professionals for guidance. These considerations are pivotal for financial planning and compliance.

Startup and Investor Perspectives on Financing Options

From a startup perspective, choosing between SAFE notes and convertible notes hinges on factors like risk tolerance and control concerns. Investors often favor SAFE notes for their simplicity and future equity potential. Conversely, convertible notes provide more security with their debt-like features. Understanding these differences can significantly impact the decision-making process for both parties involved in equity rounds. In Silicon Valley and beyond, the choice between these financial instruments can shape the trajectory of a startup's growth and investor returns.

Are SAFES Better than Convertible Notes?

These days, many entrepreneurs and small business owners agree that SAFE notes are the ideal choice due to their ease and simplicity. But the right option depends on your unique business, goals, and preferences.

Also, keep in mind that some investors may only be willing to invest using convertible notes. To make it easier for you to decide whether to opt for SAFEs or convertible notes, we’ve created this handy comparison chart.

Market Trends and Future Outlook of Financing Instruments

As the startup ecosystem evolves, the use of innovative financing instruments like SAFE notes and convertible notes is on the rise. With a focus on future equity and flexibility, these instruments cater to the dynamic needs of early-stage companies and investors. Understanding the key differences and benefits can provide valuable insights for maximizing funding opportunities and navigating the complexities of equity financing in the ever-changing market landscape.

Frequently Asked Questions About SAFES and Convertible Notes

What are the advantages of using SAFE Notes?

SAFE notes are simple, flexible, and quicker to negotiate compared to Convertible Notes. They do not accrue interest or have a maturity date, reducing the pressure on startups. SAFE notes also allow startups to raise funds without immediately setting a valuation.

What are the advantages of using Convertible Notes?

Convertible Notes provide a clear structure as they are debt instruments with a maturity date and interest. They can be more appealing to investors who want the security of a loan with the potential upside of equity conversion.

What is a valuation cap in a SAFE or Convertible Note?

A valuation cap is a limit on the valuation at which the note converts into equity. It protects early investors by allowing them to convert at a lower price per share if the company’s valuation during the subsequent funding round is higher than expected.

Are SAFE Notes considered debt?

No, SAFE notes are not considered debt. They are agreements to receive equity in the future and do not have a maturity date or interest rate, unlike Convertible Notes, which are treated as debt until they convert into equity.

Can SAFE Notes or Convertible Notes be negotiated?

Yes, both SAFE and Convertible Notes can be negotiated in terms of valuation cap, discount rate, conversion terms, and other provisions. However, SAFE notes are generally simpler and have fewer negotiable terms compared to Convertible Notes.