Questions About the PPP Loan Forgiveness Application Process

Before applying for PPP forgiveness, read this to make sure you are maximizing your forgiveness and not missing out on other benefits like the ERTC!

***President Trump has passed legislation on the Consolidated Appropriations Act, that will deliver new stimulus impacting families and businesses, while also clarifying some of the tax drama that small businesses have been dealing with. Learn more about the second round of the PPP here.***

As GrowthLab dives into everything PPP, we have fielded many questions during our weekly GrowthLab Jump sessions, office hours, and in customer meetings. Here are the top 15 questions about the PPP Loan forgiveness application process that we encountered during our live GrowthLab Jump session on Monday, June 29th. If these don’t answer your questions, just jump into one of our office hours or text us at 833-759-0277.

Keep in mind…the PPP loan forgiveness application is a tedious application. It has a lot of variables with a lot of employee data from various time periods… to help you out, GrowthLab has built numerous tools including a PPP Loan Forgiveness Calculator for both PPP Loan Forgiveness Applications — the EZ Form (Form 3508EZ) Calculator and the Regular Form (Form 3508) Calculator, as well as a guide for completion. If you have any further questions or need guidance, please contact GrowthLab. We also are providing Concierge PPP Loan Forgiveness Application services to our customers.

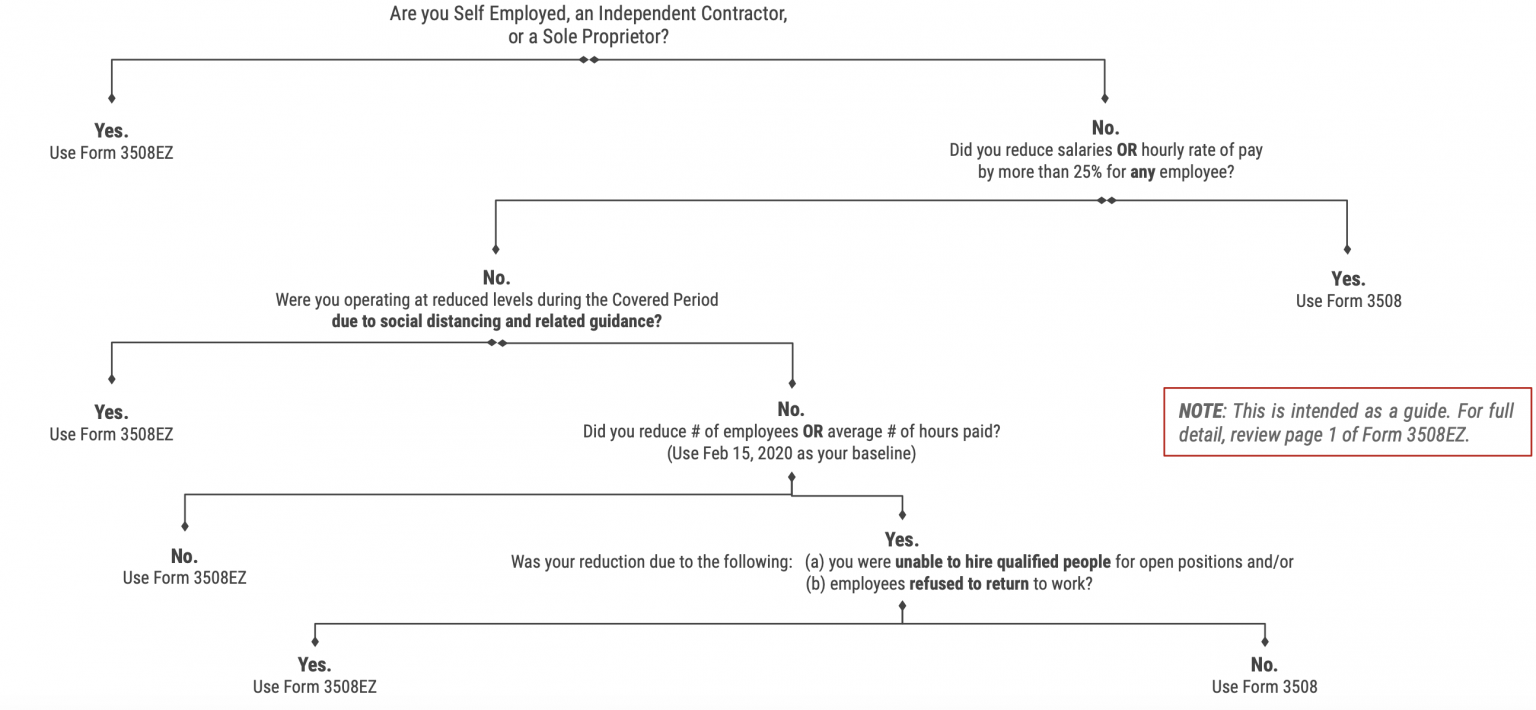

1. There are now two PPP Loan Forgiveness Applications, the original application and an “EZ” application. Which application should I use?

The best answer I can give you on this is our PPP Loan Forgiveness Application decision tree. It asks several yes or no questions to get you an answer to the “Which application do I fill out?” question.

2. Regarding the Covered Period for forgiveness, why choose the shorter 8-week period instead of the longer 24-week period?

Unfortunately, a lot of these things aren’t binary. I wish I could give a straightforward answer applicable to everyone, yet for many people, it comes down to cash. You may simply not have money to continue keeping people employed for 24 weeks. Maybe you were planning to furlough them after the 8-week Covered Period. On the flipside, why you may want to go with the 24-week Covered Period simply because if you had to downsize your headcount during COVID. In that case, many companies will be able to maximize forgiveness by utilizing the longer Covered Period even though you get “dinged” for downsizing heads…more on that later.

One of the key drivers to this decision is your “FTE reduction quotient” as the forgiveness application calls it. How much have you reduced headcount from where you were to where you are today or where you are going to be over the Covered Period? Some people were planning for the eight weeks. They plan, they hire accordingly. And it’s going to make much sense for them to stick with eight weeks.

Others are going to have lower payroll costs, but now they can extend it over a 24-week period. Thus, even though you’re only able to include half of your payroll expenses (due to the FTE reduction quotient), you have a larger payroll expenses and therefore are going to be able to still maximize your forgiveness.

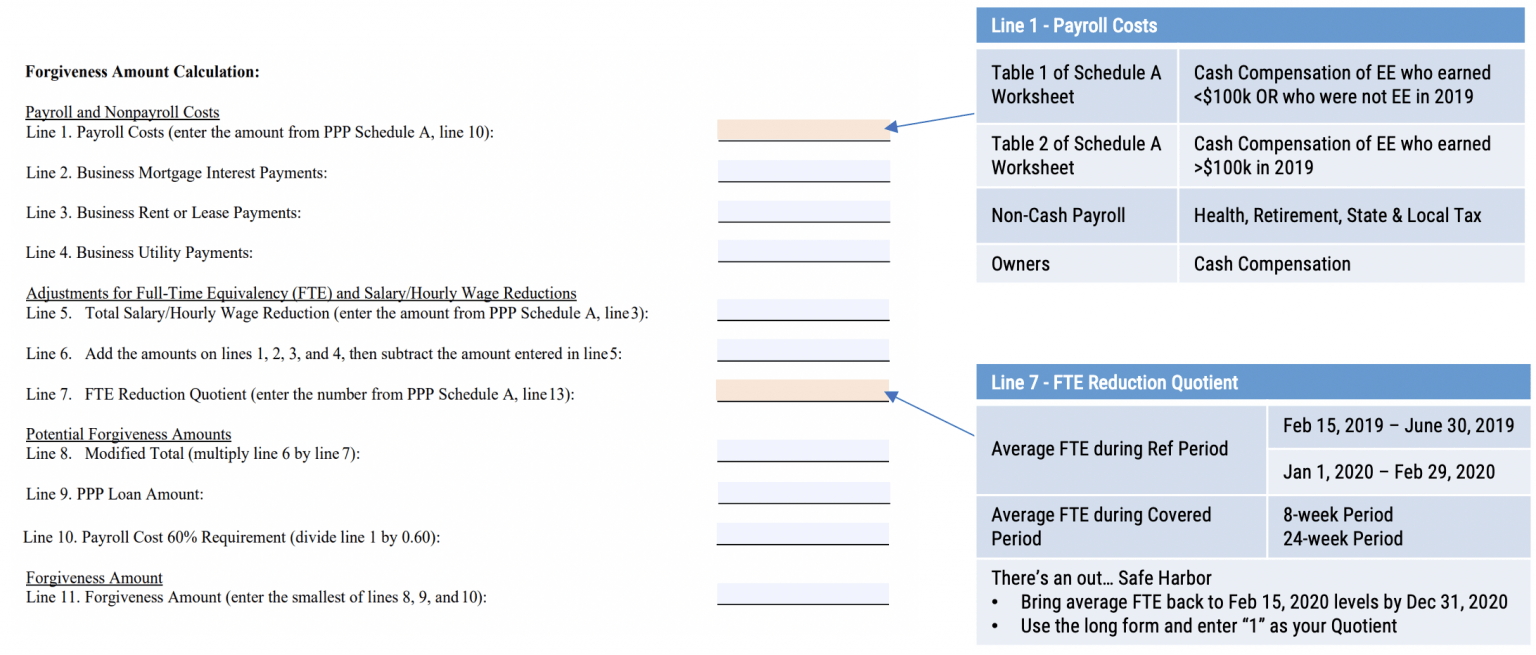

3. What are the key drivers of the forgiveness calculation?

The two key drivers of the PPP Loan Forgiveness Application are Line 1 and Line 7 of the Forgiveness Amount Calculation. These are the “Payroll Costs” and “FTE Reduction Quotient,” respectively. You may think that “Payroll Costs” are straightforward, but the formulas, tables, and worksheets behind that “Line 1” have a lot going on. The “FTE Reduction Quotient,” similarly, has a lot of info and data behind it. This gets into the specifics of the application so let’s look at the actual application. Below is an annotated screenshot of the application — Form 3508 — the forgiveness amount calculation.

Let’s dive into “Payroll Costs.” Payroll costs are more straightforward than your FTE Reduction Quotient. If you’re looking at the actual application, Line 1 comes from PPP Schedule A, Line 10. In turn, Line 10 is made up of the following:

- Cash compensation from Table 1 of Schedule A Worksheet. This is for employees who earned less than $100,000 or who were not employed in 2019.

- Cash compensation from Table 2 of Schedule A Worksheet. This is for employees who earned more than $100,000 in 2019.

- Non-cash payroll expenses including health, retirement, and state & local taxes.

- Owners cash compensation.

For the average small business, most of your employees are probably going to be on Table 1. For those companies that had people making more than $100k in 2019, you will also have information in Table 2. This gets into some of the complication of creating the documentation in the Schedule A and Schedule A Worksheet. Those worksheets require information to be gathered for each individual employee by week. To simplify organizing the information, download our Excel toolkit and fill it out.

Non-cash payroll items are health insurance, retirement benefits and state & local payroll taxes. Federal payroll taxes are not included. Those are on a separate line of the application because these are part of compensation, but it’s non-cash compensation to your employees.

For the owner’s cash compensation. This line is for cash compensation to owners that is paid through payroll.

Regarding the FTE Reduction Quotient, this is formulated based on your headcount during the Covered Period (8- or 24-weeks, depending on what you choose) compared to your headcount during the Reference Period. Again, use our Excel toolkit to help you gather and organize your data.

And these two drivers play together to impact your forgiveness. If “Payroll Costs” multiplied by your “FTE Reduction Quotient” are lower than your loan amount, the full loan amount cannot be forgiven. So, back to the question of whether you choose the 8-week or 24-week Covered Period… If you have lower headcount and lower payroll during the Covered Period than during the Reference Period, you are likely going to benefit from the 24-week Covered Period because (a) your “Payroll Costs” number will be larger which will counterbalance the diluting factor or the FTE Reduction Quotient.

FTE & RELATED

4. How are FTEs calculated?

The PPP Loan Forgiveness Application has two ways to calculate FTEs. You can either calculate them per employee with actual weekly hours divided by 40 hours; thus a 30 hour person would be 0.75 FTE. Alternatively, you can use a binary option of either 1.0 for anyone who is full time at 40 hours and 0.5 for anyone who works under 40 hours. The caveat is that you have to use the same calculation methodology for both the Covered Period and the Reference Period meaning whichever way you go, you have to be consistent in both a Reference Period and the Covered Period.

5. For FTE count, there are two possible Reference Periods. Can I choose whichever reference period I want?

Yes, you can choose either. So you will likely choose the one in which you have your lower number of FTEs. You have the option to choose either, just make sure that you use the same method of calculating FTEs for your Reference Period and your Covered Period.

6. In terms of reducing hours, is that on a per employee basis or overall across the company?

A lot of part time employees have voluntarily chosen to leave because they earn more in unemployment and covered stimulus funds. It is on a per.

This is on a per employee basis. That being said, it is calculated based on hours and headcount of people that work during your Covered Period. If you had somebody that left as soon as COVID hit, they are going to be in your Reference Period numbers, but they will not be in your Covered Period numbers. You don’t have to put zero in for them if you hired somebody else in their place.

When you hired somebody else in their place in your headcount, your headcount would be the same from the Reference Period to the Covered Period. If you didn’t hire somebody to replace that person, then it would bring your FTE down. That said, if you offered to have them come back and they said no (maybe because they’re making more money on unemployment), then you may be able to use the EZ application (use the Application Decision Tree to check). If that’s the only thing that would push you into the long form, you can choose to go to the easy form. Just provide documentation that you offered to bring them back and they refused.

7. What is the February 15th baseline?

The February 15th baseline is for your FTE count when you use the short form application– the “EZ” Application. And that is just a snapshot in time that they are using as a pre koban number or with what the baseline is in the easy application criteria.

If you go the long form, you do have other other choices to make. Like we reference in other questions, there are two reference periods if you use the long form application.

8. So if we have all full time employees. But may work 39.75 hours a week. Will they not be considered full time as one point five?

If all your employees work the same average hours in the Reference Period vs the Covered Period, than the fact that they are under 40 hours does not matter. It does not matter if you have 50 employees at 0.5 FTE each or 25 employees at 1 FTE each as long as the profile is the same from Reference Period to Covered Period. What matters is any differences between the Reference Period and the Covered Period. Said another way, if your employee profile looks the same as it did in the current period, you are going to be good.

SAFE HARBOR

9. Is there a Safe Harbor?

There is a safe harbor. And that safe harbor protects you from a reduction in your forgiveness, if you can get your numbers back up to pre-COVID amounts by or before December 31st. For instance, if you get back to February 15th, 2020 FTE levels by December 31st, you can just automatically enter “1” as your FTE Reduction Quotient. Therefore, based on your headcount reduction, you don’t get any reduction in your total forgivable amount.

DOCUMENTATION & LOGISTICS

10. How long does it take for the PPP forgiveness application to get reviewed?

What I heard from the banks we have been talking to is that the banks have approximately 60 days to filter those applications. Then the SBA has another 90 days to determine whether they are going to accept it. So that’s 150 days between the time that you apply for forgiveness and when you actually get your final decision. Yes, it could be shorter, but I’m going to go on a limb and say I’m going to assume that 150 days. So five months

11. Can I use 100% of the PPP for payroll and get it all forgiven or am I limited to spending 60% of the PPP on payroll?

Yes, you can use 100% on payroll and get 100% forgiven. The 60% stipulation is not a limit on payroll. Rather, it is a limit on the non-payroll expenses. Those non-payroll expenses (rent, utilities, etc.) cannot be more than 40%.

12. What’s supporting documentation is the SBA expecting to back up the numbers on our application?

So there’s no specific guidance around that. The banks we have been in discussion with did not give clarity into that. They frankly don’t know. Be conservative and over-deliver on the documentation side. Gather the documentation as you collect the data. Gather anything related to an expense that you put it on your application.

If you have two backup documents, put them both in there. Also, don’t just wait for another day to gather the documents. Do the gathering of documents as you are putting your application together, as you’re calculating your numbers. Put the documents in a data room which is, essentially, a fancy name for a digital folder that you can share with your lender.

OWNER COMP

13. If an owner is not paid through payroll, are they considered in forgiveness?

No. If the cash to the owner does not go through payroll, do not include it. For instance, any payments to an owner of an LLC are not included. Any distributions to an owner of an S-Corp are not included.

14. So if you are self-employed as a realtor and don’t have any employees, what forms do I fill out?

If you are self-employed, just go straight to the EZ application.

WHEN WILL BE INCOME

15. Have you heard anything about how the government is going to go about recognizing that loan as income?

So if it is forgiven, the monies turn into income. They turn into income at the time that the monies are forgiven. Anything that is not forgiven remains on the balance sheet as a loan and needs to be paid back. So, thinking of tax planning. The forgiveness is going to directly — on a dollar-for-dollar basis — increase your Net Income (or decrease your Net Loss) and, thus, the forgiveness has a direct impact on tax planning.

Remember, also, that there is potentially a 5-month window from when you submit the application to when it gets forgiven. Thus, unless you get your application done in the next 30 days, you are not guaranteed to have the forgiveness be completed in 2020.