The Paycheck Protection Program Calculator

There is a TON of activity right now with the CARES Act’s Paycheck Protection Program. It is a GREAT program for small and medium sized businesses.

If you’ve been reading our emails or joining us for the weekly “GrowthLab Jump,” we have been “preaching” that this loan makes total sense for the “forgivable” portion; yet we need business owners to be smart about planning for any unforgivable portion.

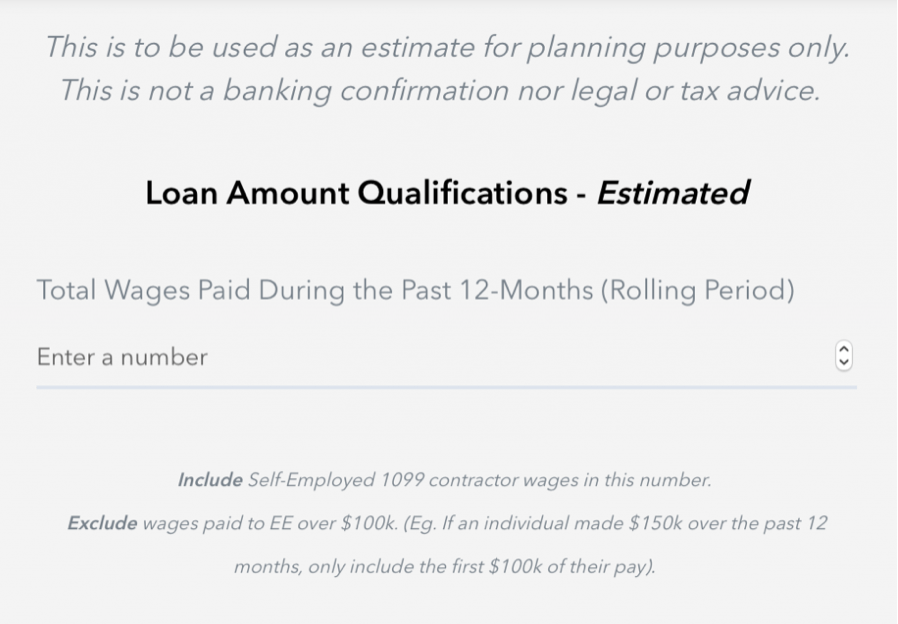

We created a Paycheck Protection Program (PPP) calculator to estimate the:

- Potential maximum loan amount,

- Likely forgivable amount, and

- Remaining balance that would convert into a term loan.

It is a great tool for estimating and scenario planning because our #1 goal right now is to help you with short-term cash flow and liquidity needs.

Let us know if you need help figuring out what is “in” and “out” of the “payroll costs” number…it is not JUST gross wages, there are other things you can include. Our focus is to be conservative and maintain the backup you need six months from now when the dust settles.

We are actively helping customers apply and gather the backup documentation needed to substantiate the numbers. If you need help with any of this, let us know.

We are big fans right now of the BIG THREE…helping our customers have visibility and confidence in their 3-week, 3-month and 3-year plan.