Understanding Valuation Caps

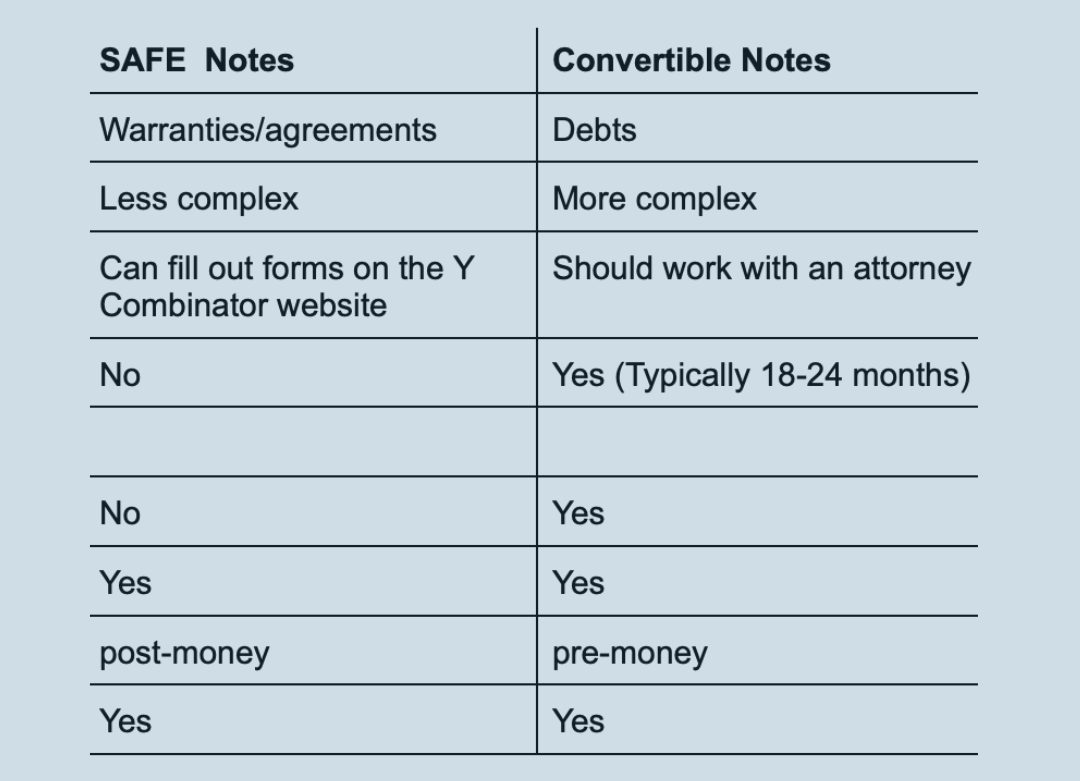

You often find Valuation Caps in Convertible Notes or SAFEs, which are commonly used in fundraising for startups. For this article, we are going to focus on the valuation cap of a convertible note, which is the maximum price or valuation at which the note will convert into equity. This protects investors from dilution if the startup achieves a very high valuation in its next round, ensuring that their investment is not disproportionately small compared to the company's value. While a valuation cap doesn't prohibit the valuation of the company from exceeding a threshold, it does limit the amount that can be used in determining the conversion of the note to stock. However, there are possible drawbacks to valuation caps. If the startup's value becomes unexpectedly high in subsequent rounds, it could eclipse the cap to the investor's disadvantage. If you want to learn more about valuation caps for SAFEs and how they play a crucial role in fundraising, check out Y Combinator (They introduced the SAFE (a simple agreement for future equity) in late 2013.)

Suppose you’re considering convertible debt from potential investors for your company. In that case, it’s essential to familiarize yourself with what a convertible note is and how a valuation cap affects the current shareholders, especially founders, and those buying in through the convertible note.

A convertible note is a loan that converts to equity when a triggering event occurs (Check out TechCrunch blog). Typically, the trigger event is when the company completes the next round of financing, also known as a priced round (or an equity investment). Here’s how it works: an investor lends money to a startup, and the investor earns interest while the loan is outstanding; when the loan converts to equity, the value of the principal and interest, including the interest rate, are converted from a convertible loan into equity at a later date based on the company's valuation at the time of the trigger event. This is an important factor to consider in a convertible note, as it can greatly impact the company's valuation and the potential return for investors.

Need help with your Cap Table?

Fill out the form to download our Cap Table GPT!

Why a Floor and Convertible Note Cap?

One of the main reasons early stage companies use convertible notes to raise capital is that the company can obtain funding without establishing a specific valuation on the business (which is needed when selling equity directly). This is of particular benefit for early stage companies because it gives you the chance to mature the company before determining the enterprise value at which you will sell equity. This helps to reduce dilution and raise less money, giving you a shorter runway to focus on building your business and determining the company’s current value in the rapidly growing fintech industry.

A valuation cap is used in a convertible note to give the noteholders a “ceiling” value at which their investment will convert and, in turn, that gives them a “floor” in regards to their ownership. With a valuation cap, they know that their money will convert from loan to equity at or below a certain dollar per share price established by the maximum valuation of the issuing company. This ensures that the investors are protected and have the potential to receive a higher return on their investment, as the conversion price is limited by the valuation cap.

Example of a Valuation Cap

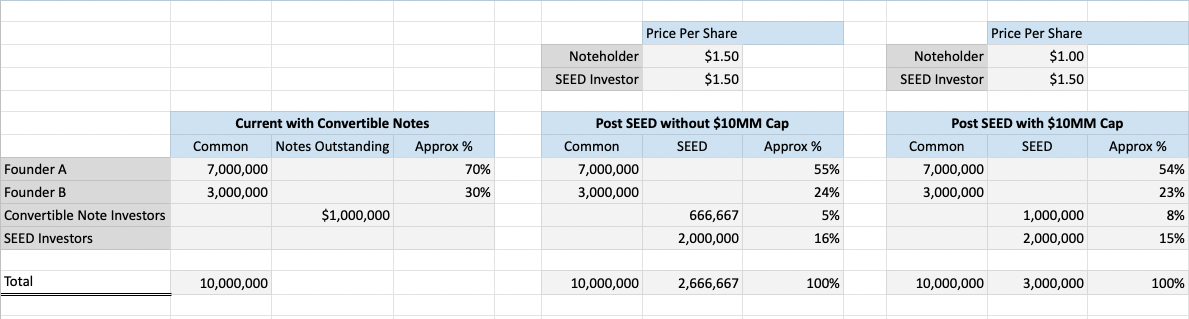

Here's a scenario with a convertible note example. Let’s say an investor invests in your company. They invest $1MM into the company via a convertible note that has a $10MM valuation cap. The cap table of the company is simple -- it has 10MM of common shares today held by two founders. Later, the company raises a Series SEED round of $3MM at a $15MM pre-money valuation, resulting in an increase in the number of shares and a potential dilution for the initial investor. This is where the terms of preferred stock, such as a valuation cap, come into play and can greatly impact the investor's return on investment.

Without a valuation cap, the monies from the convertible note will buy in directly alongside the SEED money at $1.50 per share (=$15MM pre-money valuation / 10MM shares outstanding). This is illustrated in the middle cap table below. However, with the valuation cap, the noteholders will be able to buy in at a lower price of $1.00 per share (=$10MM valuation cap / 10MM shares outstanding), which is illustrated in the right cap table below. Thus, with the convertible note terms of a valuation cap, the noteholders buy 1MM shares (assuming no interest), whereas without the cap they would only buy 666,667 shares.

Investing in startups can be a complex process, but understanding terms like "valuation cap" is crucial for making informed investment decisions. On the flip side, founders need to understand the impact on their founder shares and the company. If you're still asking what is a convertible note, check out GrowthLab's Virtual CFO services and FP&A Team to help you navigate cap tables and capital raising, including the pros and cons of using convertible notes for new investors.

Benefits of Valuation Caps

You may be asking, “Why would I want to risk selling equity at a discount?” Well, you do this because many convertible note investors will require a valuation cap or discount rate in order for them to invest in the company via the note. This benefits both the company and the convertible note holder, as it allows for a lower purchase price for the shares at a subsequent equity financing. You also do this because you want to incentivize those early investors (noteholders) to bring their money in early and fast, as it can lead to potential benefits in future equity funding rounds.

Interested in Convertible Notes, SAFEs, & Caps?

At GrowthLab, we help early-stage companies like yours with cap tables,

409a, and capital raising, thoughtfully. If you’re a startup in search of investors, you can count on us to show you how to use a valuation cap to your advantage.

Other Blogs Related to Startup Finance