Accounting Best Practices for PPP Loan

Accounting Best Practices for PPP Loan

President Trump has passed legislation on the Consolidated Appropriations Act, that will deliver new stimulus impacting families and businesses, while also clarifying some of the tax drama that small businesses have been dealing with. Learn more about the second round of the PPP here.

The GrowthLab Weekly Jump is an information session hosted every Monday that tackles relevant issues in today’s trying times. Jumpstart your week with practical advice in times of uncertainty.

In case you missed this week’s Jump session, you can find the slide deck below:

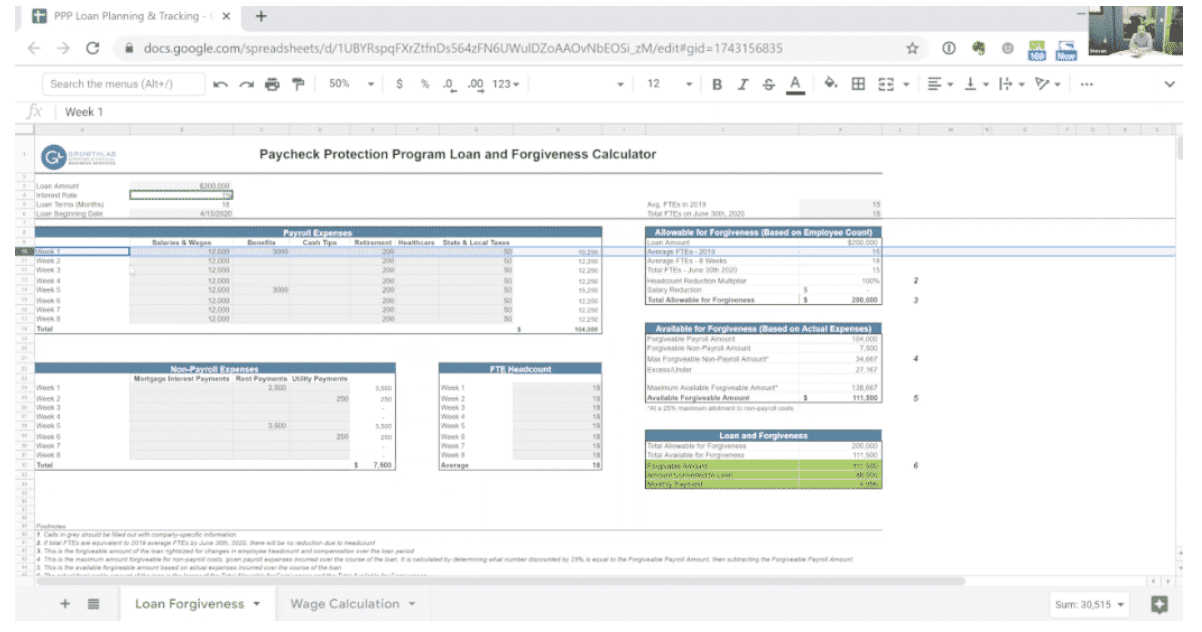

This week’s focus is getting organized today to maximize your PPP loan forgiveness. With your plan from last week, you can start tracking this week.

Actions for this week–

- Starting Block: Implement Accounting Best Practices

- Set up Weekly Process

Action 1: Implement Accounting Best Practices

- Create a dedicated bank account

- Use this account for your loan and only transfer money out for “forgivable” stuff

- Create a new class in your accounting system

- Class ALL transactions that relate to forgivable expenses

- Attach source documents to each PPP Loan transaction

- Do this directly in your general ledger

- Make it easy for yourself (and any auditor) to find the transactions AND the source docs

Action 2: Set up Weekly Process

- Tracking of PPP Forgiveness Expenses

- In addition to your general ledger class, you should have a tracking spreadsheet that aligns with your plan

- Reconcile Actuals vs Expected from Last Week

- What did you expect to spend on forgivable expenses

- What did you ACTUALLY spend on forgivable expenses

- Review & Adjust Plan

- Based on reconciliation and expectations for upcoming weeks, adjust the plan for remaining PPP loan performance period

Check out GrowthLab’s PPP Loan Calculator here!

Check out More of our Recent Content!

GrowthLab is your Finance-as-a-Service partner

that serves Founders and Management Teams with