Need Help Cleaning Up Your Books?

Submit the form below

How Do I Get A Second PPP Loan?

It Entirely Depends on Having Accurate and Timely Financials

The Consolidated Appropriations Act will deliver new stimulus impacting families and businesses, while also clarifying some of the tax drama that small businesses have been dealing with.

If you are looking at applying for the second draw of PPP loans, accurate books are absolutely critical!

Below are the top 10 most important items for SMBs coming out of this bill.

For those businesses that need just a little bit of help or would rather work on their business and not a 12-page application, we've developed two service offerings to get you through the process, check it out below.

Lastly, our lawyer friends have asked us to provide you with some disclosers, see below.

DIY

FREE

Download Package

Full Service

$2,500

Consultation

$500

Why Your Second PPP Loan Will Depend on Strong Books

So... we made it past the first round of stimulus money. It was a messy show, and much to learn. Businesses and banks were confused, stressed, and eager to get the money out.

Having been through this already, we don't anticipate round two will be as simple of a process. With less resources to go around and more applicants ready to take a bite at the apple. What we can count on is that applications will be dependent on strong, clear, and quality data.

On top of this, as great as it is to get the money, it is almost equally as important to get the funds forgiven. Forgiveness will be dependent on the ability to prove to the SBA that your information is accurate, and that you spent the moneys in the correct places.

A kicker to this is the ability to include some of your accounting costs in the forgiveness formula!

Top 10 Most Important Items In The 2021 Appropriations Bill

- Forgiven PPP "loans" will not have adverse tax impact on businesses. specifically, the forgiveness is not taxable and forgiven expenses are deductible.

- The second draw of PPP borrowing will open shortly.

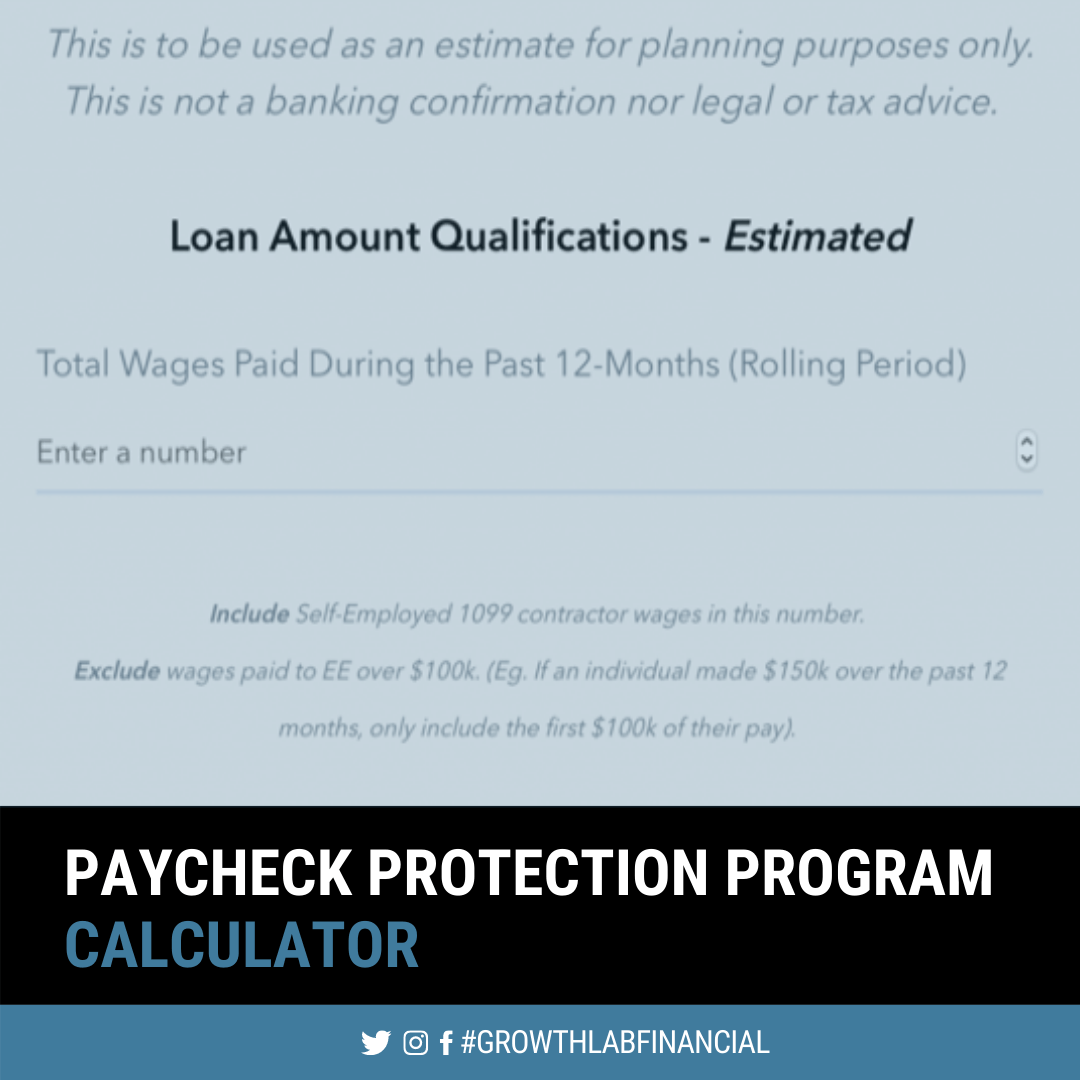

- To qualify, you need to show a 25% drop in gross receipts during a quarter in 2020 relative to that same quarter in 2019.

- Second draw PPP loan size is 2.5x the trailing 12 month average monthly payroll

or

2019 average monthly payroll. Restaurants and hospitality are able to receive up to 3.5x these payroll numbers.

- For new PPP borrowers, the covered expenses now include:

- Covered Operations Expenditures - Business software or cloud computing service, select payroll and HR expenses, and accounting expenses.

- Covered Property Damage Costs - Costs related to property and vandalism or looting due to public disturbance that occurred during 2020 that was not covered by insurance or other compensation.

- Covered Supplier Cost - An expenditure made to a supplier that is essential to the operations.

- Covered Worker Protection - Operating or capital expenditures required to adapt your physical space to comply with Department of Health and Human Services, the CDC, or OSHA.

- Meals will now be 100% deductible for the 2021 and 2022 tax year.

- Any unused health or dependent care FSA benefits can be carried from 2020 to 2021.

- The payroll tax deduction will be extended through the end of 2021.

- There will be a "targeted" EIDL program for businesses in low income or minority communities.

- PPP loans under $150k can now use a one-page certification for loan forgiveness, which does not require backup documentation (although we still recommend backup).

See How We Help Prepare Your Books To Receive The Second PPP Loan

More Information on the PPP

GrowthLab is your Finance-as-a-Service partner

that serves Founders and Management Teams with