EZ PPP Loan Forgiveness Application Calculator

EZ PPP Forgiveness Calculator

Before applying for PPP forgiveness, read this to make sure you are maximizing your forgiveness and not missing out on other benefits like the ERTC!

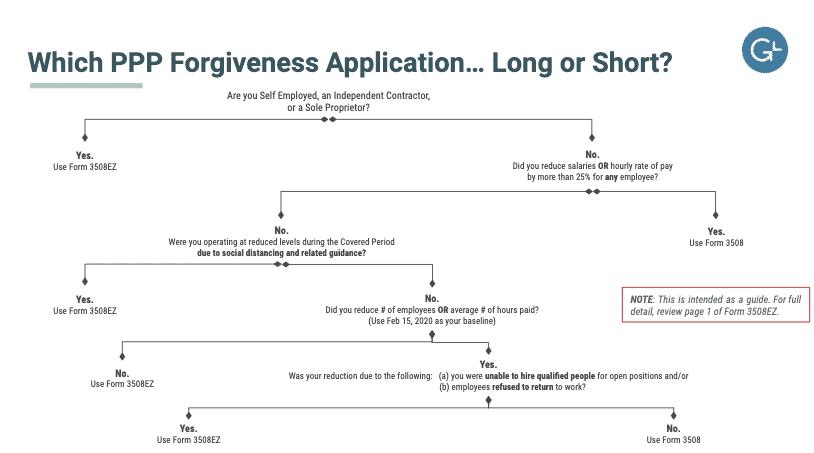

Recently, GrowthLab provided you with the 5 steps necessary to complete your PPP Loan Forgiveness Application (Form 3508). Since then, the SBA has released an additional, shortened version of the standard application meant to reduce the complexity of the PPP loan forgiveness application process. The new EZ PPP Loan Forgiveness Application (Form 3508EZ) can be used by borrowers who meet any of the three criteria detailed on page 1 of the EZ Application. We simplified these three by making the following decision tree to help you determine whether to use the new EZ Application, or the standard Application.

How to determine if you can use the EZ PPP Loan Forgiveness Application: Answer these yes/no questions.

The EZ Application is intended for Borrowers with simple organizational structures (sole proprietor, self employed, etc.) and for Borrowers who maintained pre-COVID-19 wage and headcount levels during the Covered Period of their PPP Loan. If you reduced salaries or hourly rate of pay, you must use the standard application. However, there are two caveats regarding headcount which are as follows:

- If you could not operate at pre-COVID-19 levels due to social distancing and related guidance, you can still use the EZ Application.

- If you did reduce employee headcount, but are unable to fill open positions with qualified individuals, or if employees refuse to come back to work when offered, then you can still use the EZ Application.

Because the EZ Application does not capture wage or FTE reduction information, the calculations for the EZ Application are simplified. Therefore, some of the key technical difference between the standard and EZ SBA PPP Loan Forgiveness Applications include:

- The Section A Workbook and Section A Form required for the original forgiveness application do not need to be completed and submitted with the EZ Application.

- The EZ Application does not require the Borrower to complete calculations comparing employee wage levels during the Covered Period of the loan to pre-COVID-19 levels to determine whether the forgiveness amount of the loan must be reduced.

- Similarly, the EZ Application does not require calculations to determine employee FTE levels during the Covered Period of the loan, as compared to pre-COVID-19 levels.

- As it is assumed that Borrowers filling out the EZ Application did not reduce wage or FTE levels, the safe harbor analyses necessary for the standard Forgiveness Application are not included in the EZ Application.

Essentially, the EZ Application allows Borrowers who kept employee wages and FTE levels at pre-COVID-10 amounts to skip the complex calculations of potential forgiveness reduction and the subsequent safe harbor analysis necessary for the full SBA Forgiveness Application.

Even if you qualify for the EZ Application, it is important to still document the weekly wages and hours worked by each employee during the Covered Period of the loan. Although the SBA has not released official guidelines detailing the supporting documentation necessary for your Forgiveness Application, detailed breakouts of your wages and headcount will demonstrate that you did not decrease wages or hours for individual employees. GrowthLab is providing a free EZ PPP Loan Forgiveness Calculator which will help you organize your employee wages and hours worked during the Covered Period of the loan and give you the data points to complete the EZ Application.

Looking for more information on the Paycheck Protection Program? Check out some more of our resources below!

Check out More of our Recent Content!

GrowthLab is your Finance-as-a-Service partner

that serves Founders and Management Teams with