Filling an 83(b) Election: A Step-by-Step Guide

Filing an 83(b) election is a critical process for employees who receive restricted stock as part of their compensation. This election allows you to pay taxes on the total fair market value of the stock at the time of granting rather than at the time of vesting, potentially leading to significant tax savings. In scenarios involving

valuation caps, understanding the fair market value at the time of the grant is essential, as it directly impacts the potential tax benefits. Here's a detailed, step-by-step guide on how to file an 83(b) election, including necessary documentation and IRS submission guidelines.

Step 1: Understand the Requirements

Before filing an 83(b) election, it's essential to understand the specific requirements and implications:

- Eligibility: You must receive restricted stock, not stock options or other types of equity compensation.

- Timing: The election must be filed within 30 days of receiving the stock.

- Tax Implications: You will pay income tax on the fair market value of the stock at the time of the grant, which could be beneficial if the stock's value increases significantly over time.

Step 2: Obtain the Necessary Forms

To file an 83(b) election, you will need the following documents:

- 83(b) Election Statement: This is a formal letter to the IRS stating your intention to make the election.

- Cover Letter: While not required, a cover letter can provide additional context and ensure your election is processed correctly.

- IRS Form 2848 (Power of Attorney and Declaration of Representative), if someone is filing on your behalf.

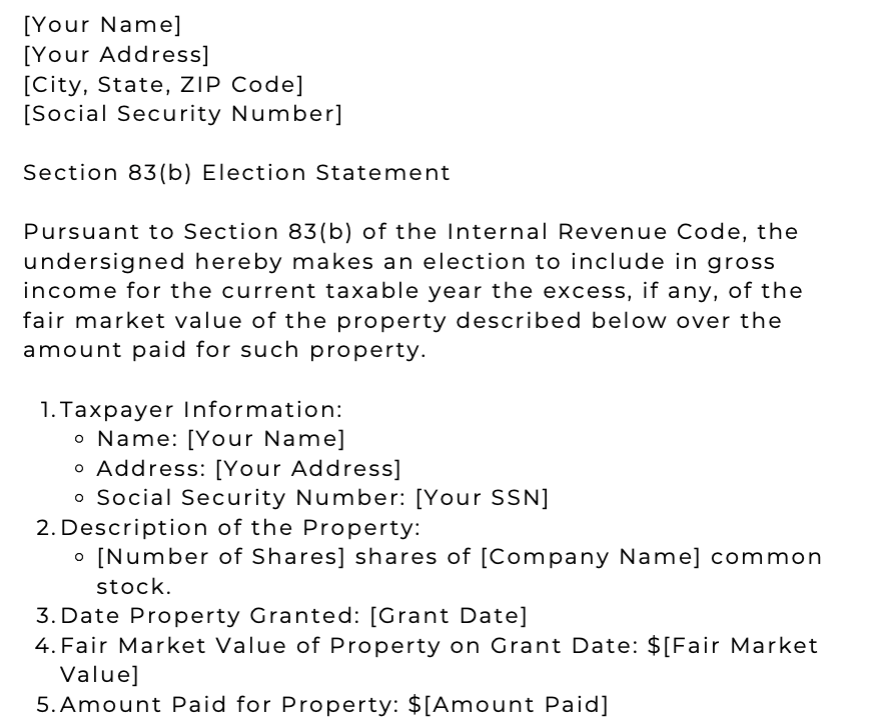

Step 3: Complete the 83(b) Election Statement

The 83(b) election statement must include specific information:

- Taxpayer's Name, Address, and Social Security Number

- Description of the Property: Detail the type and number of shares received.

- Date of the Grant: Indicate the date you received the stock.

- Fair Market Value: State the fair market value of the stock at the time of the grant.

- Amount Paid: Specify the amount paid for the stock, if any.

- Declaration: Include a statement declaring your intention to make the election under Section 83(b).

Step 4: Submit the 83(b) Election to the IRS

The completed 83(b) election statement must be submitted to the IRS within 30 days of the stock grant. Here’s how to submit it:

- Mailing: Send the original statement to the IRS service center where you file your tax return.

- Certified Mail: It's advisable to use certified mail with a return receipt requested to ensure the IRS receives your statement

Step 5: Provide a Copy to Your Employer

You must also provide a copy of the 83(b) election statement to your employer. This step is crucial because your employer needs to be aware of your election for their tax reporting purposes.

Step 6: Attach a Copy to Your Tax Return

When you file your income tax return for the year, attach a copy of the 83(b) election statement to your return. This ensures that the election is documented in your tax records.

Step 7: Retain Copies for Your Records

Keep copies of all documents for your personal records, including:

- The original 83(b) election statement.

- The IRS-certified mailing receipt.

- Copies provided to your employer.

- The copy is attached to your tax return.

Key Considerations and Risks

While the 83(b) election can provide significant tax advantages, it’s essential to consider the risks:

- Non-Refundable Taxes: If the stock value decreases after the election, the taxes paid on the initial value are not refundable.

- Employment Stability: If you leave the company before the stock vests, you may not realize the expected benefits.

- Company Performance: The election is beneficial if the company performs well and the stock value increases significantly.

Strategic Decision-Making

The decision to make an 83(b) election should be made with a clear understanding of your financial situation, the company's potential for growth, and the associated risks. Consulting with financial advisors and tax professionals can provide personalized insights and help you make the best decision for your circumstances.

Filing an 83(b) election is a strategic financial decision that can lead to substantial tax savings, but it requires careful consideration and timely action. By following these detailed steps and understanding the necessary documentation and submission guidelines, you can navigate the process effectively. If you have any doubts or need personalized advice, consult with a

financial advisor

or

tax professional to ensure you make the best decision for your financial situation.

Frequently Asked Questions About 83b Elections

What is an 83(b) election?

An 83(b) election is a tax decision allowing employees to pay taxes on the fair market value of restricted stock at the time of granting rather than at the time of vesting.

Who is eligible to file an 83(b) election?

Employees who receive restricted stock as part of their compensation package are eligible to file an 83(b) election.

What are the benefits of making an 83(b) election?

Benefits include immediate tax savings, capital gains treatment on future appreciation, and simpler tax planning.

What is the deadline for filing an 83(b) election?

The 83(b) election must be filed within 30 days of the stock grant date.

How do I file an 83(b) election with the IRS?

Complete the 83(b) election statement, mail it to the IRS service center where you file your tax return, provide a copy to your employer, and attach a copy to your tax return.

What information must be included in the 83(b) election statement?

The statement should include your name, address, Social Security number, a description of the stock, the grant date, the fair market value at the time of the grant, the amount paid, and a declaration of your election under Section 83(b).

What are the risks of making an 83(b) election?

Risks include non-refundable taxes if the stock value decreases, potential loss if you leave the company before the stock vests, and dependency on company performance.

Should I consult a financial advisor before filing an 83(b) election?

Yes, consulting with a financial advisor or tax professional can provide personalized insights and help you make an informed decision.

Other Blogs Related to Startup Finance