Starting a Bookkeeping Business

If you're thinking about starting a

bookkeeping business or a

CFO business, you should start by hiring a couple of part-time or contract employees. This is a great way to dip your toes into managing people and starting to scale things on the HR side. In the bookkeeping business, there are three things that you need to have a core competency in:

- People - It's all about people. You can use all the AI you want, maybe you have a tech stack, but you still need people to engage and interact with your customers.

- Financial Management - Financial management starts with solid bookkeeping, good controllership, strong planning, and very thoughtful leadership around financial stress.

- Digital Marketing

So start off by finding two or three people that are willing to work 10 to 15 hours a week, but don't hire them all at once, you should stagger your hires. For a while you are going to have to be knee-deep in the work, because you have to be. You will do your own business development, marketing, scoping engagement agreements, operations, and even the customer work and at the same time.

That is why you need to find people to leverage. In this business, we make money by leveraging. You start bringing in people that are at the controller level, a senior accounting manager level, and also at a bookkeeping level. When you learn how to optimize those people, that capability and the capacity will be needed to meet your customer's demands.

Find half a dozen customers and start there. Start bringing in one to two contractors or part-time employees, and start to figure out the marketing piece. You won’t be up to bat without a good website. It doesn't have to be a $50,000 website, but it does need to be a landing site. Start developing the content, the thought leadership, even if it means a little bit of

fake it till you make it.

If you're thinking about starting any business, regardless of whether it is bookkeeping or any other startup, it is important to get the content out there at least six months before your official start date. Get a website out there, start talking to people in the industry that you can bring in and do not require too much training.

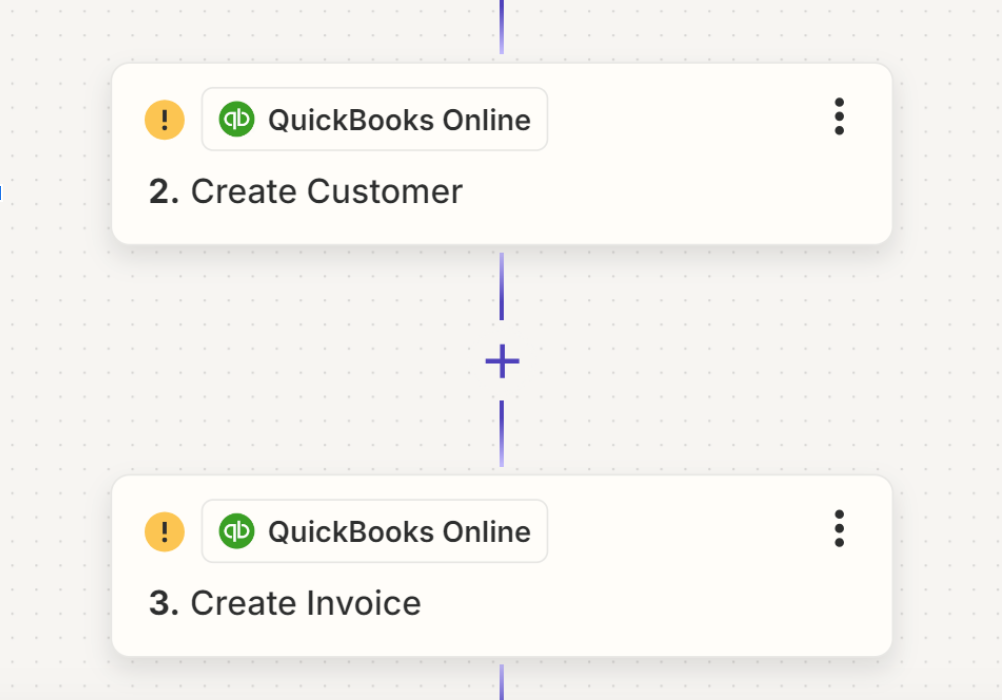

As you grow, you're going to have to start thinking about systems.

Karbonis a great one, but there are alternatives, especially for a smaller practice. But having a workflow system in place is going to be of value for any bookkeeping business. Those are our three takeaways and tips for starting a bookkeeping business. But lastly, you have to find the customers.

Other Blogs Related to Small Business Accounting