All About Remote Bookkeeping Services

In the past, you would have to hire a bookkeeper as a full-time employee. They would work in your office and you’d cover their salary, benefits, desk, office supplies, training, and more. If you don’t have the time and resources to bring an on-site bookkeeper on board, there is another solution.

With remote bookkeeping services, you can receive the financial support you need from a professional who works in a remote location. You’ll only pay for the services they provide and be able to save a great deal of time and money as a result. Since the average cost of bookkeeping services can be high, outsourcing your bookkeeping can be a great benefit for your business.

How Remote Bookkeeping Works

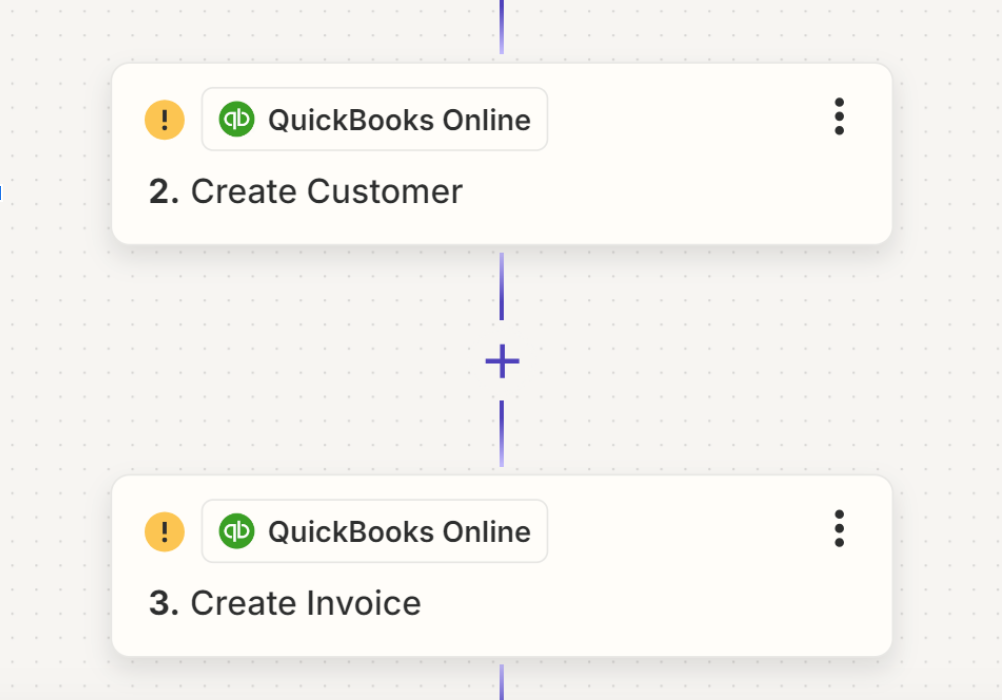

Also known as online bookkeeping or virtual bookkeeping, remote bookkeeping can allow you to receive accurate, efficient bookkeeping services without hiring a full-time employee. You’ll provide them with secure access to your financial documents and online software like QuickBooks. They will use these resources to keep your books up-to-date so you can gain control of your finances, make smart, data-driven decisions, and grow your business.

Benefits of Remote Bookkeeping Services

There are a number of notable benefits of remote bookkeeping services including:

Access to Top Talent

While every bookkeeper is different, most are highly trained professionals with years of experience under their belt. If you hire a full-time one, you may opt for a less skilled professional in an effort to save some money. With remote bookkeeping services, you can enjoy access to top talent at an affordable price point.

Save Time

Not only is it tedious, it’s also quite time-consuming. With remote bookkeeping services, you can trust another professional to tackle all of your tasks. This frees up your time as well as the time of other employees. It allows you to allocate your resources wisely and focus on big picture tasks like growing your business.

Save Money

The average age cost for bookkeeping services in-house is through salary. An in-house bookkeeper's average salary is $44,686. Now, some bookkeepers may be paid on an hourly rate, which would be a different cost. When you add in health insurance, 401k, PTO, and other benefits, the cost of hiring one is expensive. A remote bookkeeper can provide you with the precise bookkeeping you need without the high price tag. It can also save you cash on furniture, office supplies, technology, and the other miscellaneous costs of hiring a full-time employee at your location.

Scale Your Business

These services make it easier to scale your business. They offer the improved efficiency and productivity you need to meet your short and long-term goals. Without them, you may struggle with the precise financial reporting, budgeting, and forecasting that is vital to your success.

Remote Bookkeeping Services

The services you receive will depend on the scope of work you agree on. We invest in a variety of services that support your accounts payable, accounts receivable, and banking statement functions.

✅ Enter Financial Transactions

✅ Receive & Record Cash, Checks, and other Payments

✅ Assign Costs & Income into Appropriate Accounts

✅ Produce: Balance Sheets, Income Statements, Cash Flow Statements, & other Financial Statements

✅ Reconcile Discrepancies

✅ Maintain Budgets

Other Blogs Related to Small Business Accounting