What Do Online Bookkeepers Really Do?

Also known as virtual bookkeepers or remote bookkeepers, online bookkeepers can be invaluable to your business. They perform the same types of tasks as traditional, on-site bookkeepers from a remote location rather than in your workforce. Through online bookkeeping software programs and mobile apps, they can manage your business finances so you don’t have to.

With their support, you’ll be able to allocate your time and resources on other tasks like adding to your product or service line and growing your business. So what exactly are online bookkeeping services and what do online bookkeepers do? Here are several of the many tasks they can tackle.

Accounts Payable

Accounts payable refers to the money you owe to vendors and suppliers for goods or services you purchased on credit. They can handle a number of accounts payable duties. They may monitor purchase orders and invoices, code invoices with the correct ledger information, and obtain approvals for payments. They will also check invoices to ensure they’re paid in a timely manner and keep an eye for questionable transactions on your credit card statements.

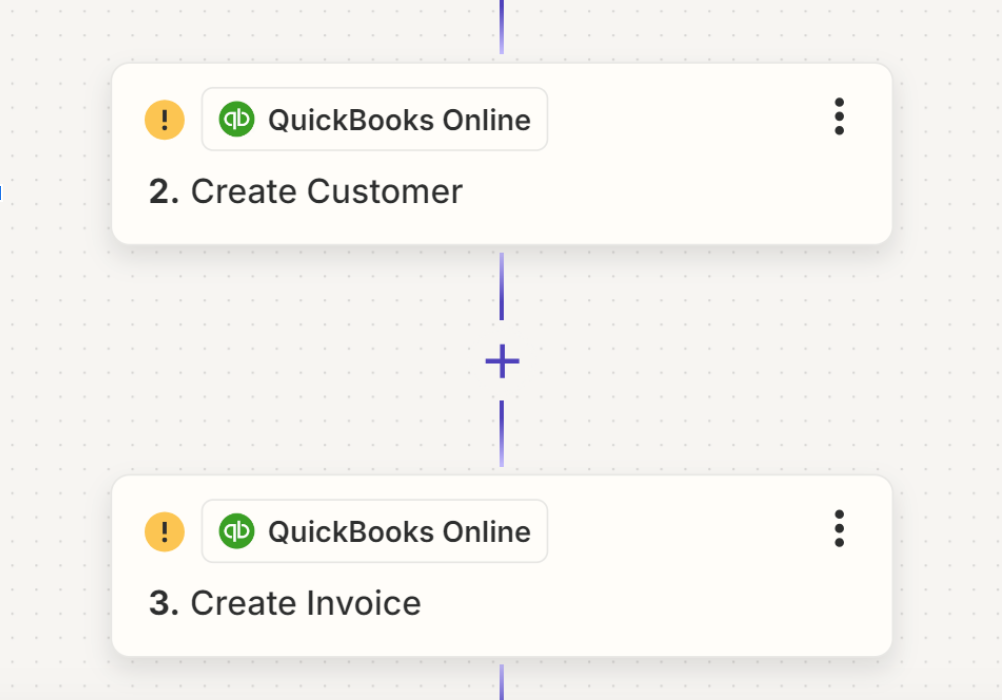

Accounts Receivable

Accounts receivable is money your customers owe you for the goods or services they previously purchased from you. An online bookkeeper may focus on accounts receivable tasks and bill customers for the work your business performed. They can create and send invoices and make sure they’re entered into the right accounts in the accounting system.

Banking

Every time an this bookkeeper receives payments from customers and other sources, they’ll prepare bank deposits. They may also reconcile bank statements and correct any discrepancies that they discover. Another common banking related task they may perform is wire transfer or ACH preparation.

General Ledger

A general ledger is essentially a master document that provides a complete record of all of your business financial transactions. An online bookkeeper typically enters information into it and reconciles general ledger accounts. In addition, they can prepare detailed journal entries and month-end reconciliation. One of their primary goals is to run the general ledger balance at the end of the month before they close the books to make sure accounts are balanced and accurate.

Online Bookkeepers are Not Created Equal

Your business is unique so the bookkeeper you partner with will have a unique set of duties to complete. Once they learn how your business works and what you hope to accomplish, they can recommend a customized scope of work. You’ll only pay for the duties they complete and save a great deal of money in the process rather than a flat monthly price.

Frequently Asked Questions

How can outsourcing bookkeeping help small businesses grow?

By offloading financial management tasks, business owners can focus more on strategy, product development, customer experience, and scaling operations, leading to stronger overall performance.

How do online bookkeepers support billing and payment processes?

They prepare and send invoices, track payments, follow up on outstanding balances, and ensure transactions are accurately recorded, keeping revenue cycles efficient.

Can online bookkeeping services be customized to my business needs?

Yes, online bookkeeping is highly flexible. Services can be tailored to your business size, industry, and goals, ensuring you pay only for what you truly need.

What types of financial tasks can an online bookkeeper manage?

Online bookkeepers handle a wide range of responsibilities, including tracking expenses, managing vendor payments, sending customer invoices, reconciling bank statements, and maintaining accurate financial records.

How does online bookkeeping differ from traditional in-house bookkeeping?

Online bookkeeping allows businesses to access professional financial management remotely, eliminating the need for an on-site employee. This provides flexibility, lower overhead costs, and access to expert services without sacrificing accuracy or reliability.

Other Blogs Related to Small Business Accounting